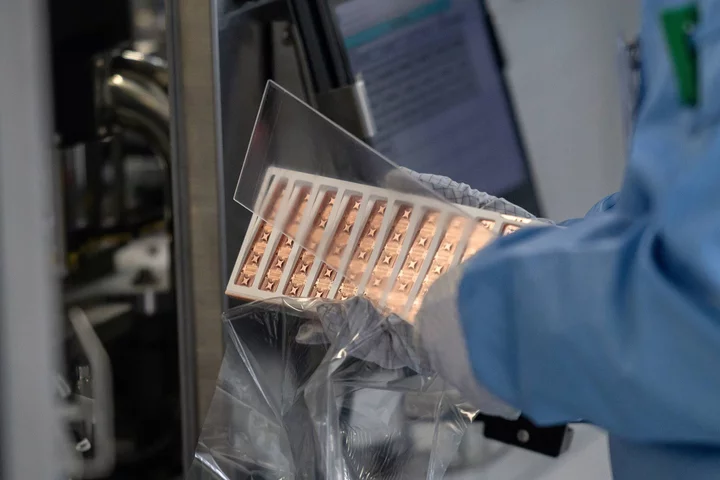

The Biden administration will tighten sweeping measures announced last October to restrict China’s access to advanced semiconductors and chipmaking gear, as the US seeks to prevent its geopolitical rival from developing cutting-edge tech that could give it a military edge.

The latest rules aim to refine and close loopholes from last year’s curbs, according to people familiar with the matter. The Biden administration seeks to strengthen controls on selling graphics chips for artificial intelligence applications and advanced chipmaking equipment to Chinese firms, the people said, asking not to be named because the rules aren’t yet public.

The US will also add Chinese chip design firms to a trade restriction list, requiring overseas manufacturers to gain a US license to fill orders from those companies, and impose additional checks on Chinese firms attempting to evade the export restrictions by routing shipments through other nations.

The US unveiled its original export control restrictions a year ago in an aggressive bid to curtail China’s technological development, a step it argued was necessary for national security at a time of rising geopolitical tensions. Beijing has bristled at the regulations and accelerated investments in developing its own technological capabilities.

The updated restrictions will be published early this week, people familiar with the internal deliberations said. A spokesman for the National Security Council declined to comment, as did a spokeswoman for the Commerce Department’s Bureau of Industry and Security.

Read more: Why Making Computer Chips Has Become a New Arms Race: QuickTake

The tighter rules come as China has made some progress in developing its domestic tech capabilities. Huawei Technologies Co., a Chinese telecommunications giant at the heart of US-China tensions, quietly introduced a new smartphone in August powered by an advanced, 7-nanometer processor. A teardown of the phone revealed the chip was produced by a Chinese company, demonstrating manufacturing capabilities well beyond what US export curbs had attempted to block.

That achievement cast doubt on Washington’s ability to thwart Beijing’s technological ambitions, and spurred significant political pressure for the Biden administration to slap more sanctions on Huawei and its chipmaking partner, Semiconductor Manufacturing International Corp.

The US has begun a formal investigation into the Huawei phone. Any resulting restrictions on Huawei or SMIC would be a separate process from the new export control rules.

The latest rules address several key issues of US-China tech policy, particularly the development of artificial intelligence technology and the shipment of technologies through other countries.

The new controls on graphics chips concern components called accelerators, which are used in data centers to train AI software. The Biden administration is tweaking the parameters which govern the export of those chips to China — a move that comes after Nvidia Corp., the leader in the field, developed a China-specific model to work around last year’s curbs.

The rules will continue to restrict shipments of certain chips to Chinese companies’ overseas subsidiaries and affiliates, and begin requiring a license to export prohibited technologies to countries that could be used as intermediaries.

At the same time, Washington has relented to companies’ calls for fewer blanket restrictions, as industry leaders say they need the ability to sell into the world’s largest chip market. Under the new rules, firms will be allowed to export to China all but the most powerful consumer graphics chips, which are typically used in gamer PCs, and will have to notify the US government before shipping a select few consumer chips at the cutting edge.

Nvidia and rival Advanced Micro Devices Inc. rely on their massive consumer chip sales to perfect and fund their research and development of data center technology.

The US also extended waivers for South Korea firms Samsung Electronics Co. and SK Hynix Inc., plus Taiwanese chip giant Taiwan Semiconductor Manufacturing Co., to continue shipping some restricted chipmaking technology to their facilities in China.

--With assistance from Shiyin Chen.

(Updates with additional context and details on AI, consumer chips)

Author: Jenny Leonard, Mackenzie Hawkins, Ian King and Debby Wu