A unit of Signa Prime Selection AG filed for insolvency in a Berlin court on Friday, Der Spiegel said, citing a request submitted by the company.

Signa Real Estate Management Germany GmbH requested the insolvency due to its inability to pay, the German magazine said.

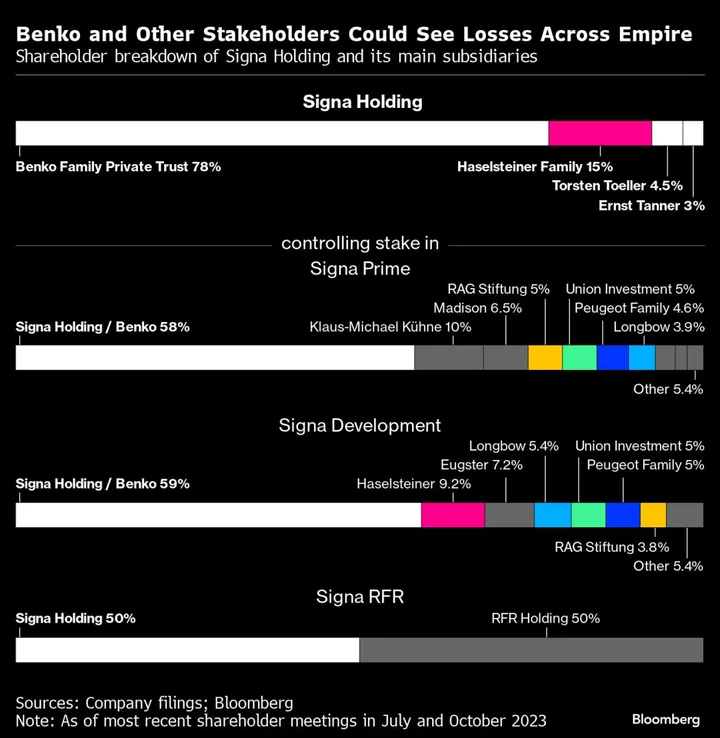

The company is a fully-owned subsidiary of Signa Prime, which co-owns the Selfridges department store in London and Berlin’s KaDeWe. Signa Prime valued its property at more than €20 billion ($22 billion) at the end of 2022, and is the largest unit within a sprawling empire founded by Austrian tycoon Rene Benko.

Signa Real Estate Management serves as “a central service provider within the SIGNA Group for the development and support of commercial properties in prime locations” in Germany, according to an annual report.

Earlier, Der Standard said Signa may hold a meeting with employees on Tuesday to inform them of the insolvency and further steps. A spokesman for Signa didn’t respond to a call seeking comment. The unit didn’t appear on a German registry of insolvency requests as of Friday evening.

Still, a filing would indicate that efforts to save the property empire are faltering, which could lead to one of the most prominent bankruptcies in recent years for European property markets.

Signa’s broader group has been seeking cash from investors to plug a €500 million funding gap this year alone, and another €1.5 billion by the middle of 2024. Signa Holding appointed restructuring expert Arndt Geiwitz earlier this month to lead Arndt Geiwitz a turnaround and mend financing strains that had brought construction work at several projects to a standstill.

--With assistance from Libby Cherry, Steven Arons and Laura Malsch.