Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

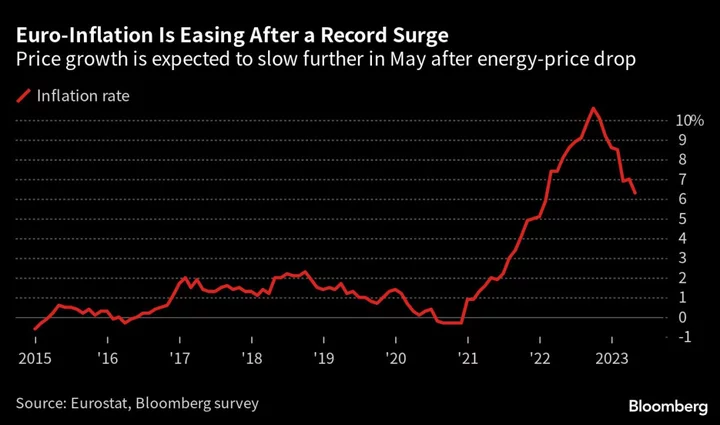

The European Central Bank may not even consider lowering interest rates for at least a year in order to vanquish inflation, according to Governing Council member Peter Kazimir.

In an interview, the National Bank of Slovakia chief said officials will stay alert to consumer-price risks even if no more increases in borrowing costs are currently envisaged. It’s equally premature to accelerate the wind-down of the ECB’s balance-sheet while they see that policy through, he added.

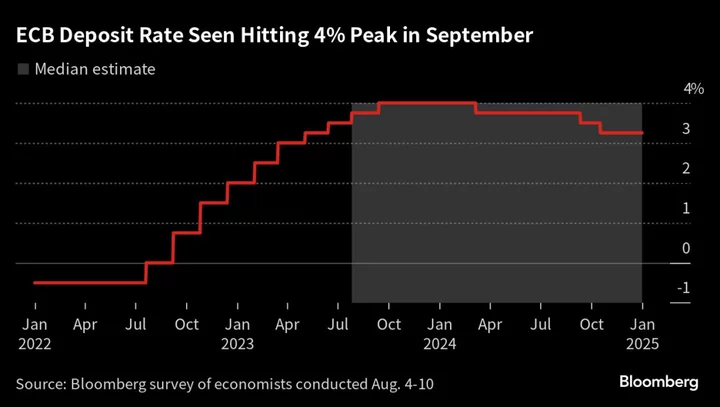

“Our focus is now on maintaining rates at a plateau,” Kazimir said, speaking in the Moroccan city of Marrakech, where he’s attending meetings of the International Monetary Fund. “It could be a year before we’ll consider cuts.”

The ECB raised rates for a 10th consecutive time last month and said that, barring any surprises, it will keep them at current levels for a “sufficiently long” time to ensure inflation returns soon enough to 2%.

While economists and financial markets were skeptical at first that policymakers would carry that out, they’re now starting to sign on to the idea. That’s partly driven by concerns that wage growth in the 20-nation euro zone hasn’t yet peaked.

Such concerns prompted several of Kazimir’s colleagues to argue in interviews this week that speeding up quantitative tightening by ending reinvestments in the ECB’s pandemic-era bond portfolio would be a logical next step to tightening. The Slovakian says that shouldn’t be rushed.

“I don’t expect changes to PEPP before the summer,” he said. “We first have to be sure to be done with rate hikes. The logic order of our toolbox is important.”

Similarly, Kazimir is unconvinced for now about withdrawing significant amounts of liquidity from financial markets by raising minimum reserve requirements — currently set at 1% of certain assets on banks’ balance sheet.

“Going back to 2% on reserve requirements would be OK for me, but I wouldn’t want to do more at the moment,” he added “We need to be careful not to cause additional volatility in markets.”