The UK housing market is sputtering again, with economists predicting that the downturn has further to run as rising interest rates bite into the budgets of consumers.

The recession warnings from former US Treasury Secretary Larry Summers and Moody’s came alongside data showing that house prices had resumed their decline last month and mortgage approvals unexpectedly fell in April. Households repaid mortgage debt at an historic pace.

The data indicates more pain ahead for Britain, which is suffering economic stagnation and the worst inflation among Group of Seven nations. Trouble in the housing market could also cost Prime Minister Rishi Sunak’s ruling Conservative Party, which is trailing the Labour opposition in polls ahead of an election expected next year.

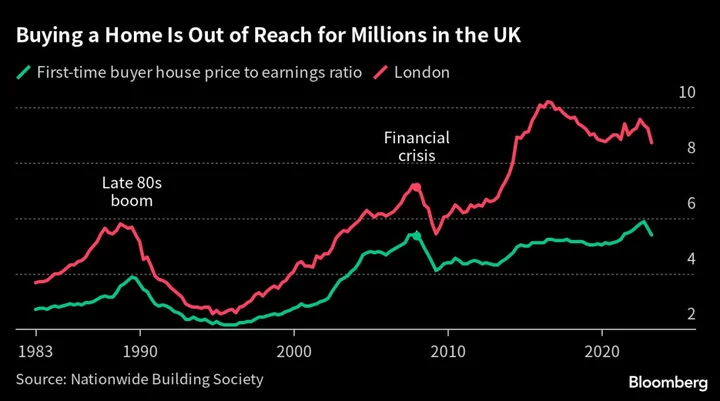

Following are the key charts showing the outlook for UK house prices:

The Bank of England has raised interest rates from 0.1% to 4.5% since late 2021 in an effort to tackle stubbornly high inflation. Yet households have yet to feel the full impact.

About 1.3 million households will do so this year when they are forced to refinance cheap fixed-rate deals at substantially higher rates. That could add around £200 ($250) a month to the interest payments of the average mortgagor, according to the BOE.

Those rates could be even higher than thought just a few weeks ago, after a shock inflation reading last month dashed hopes of a pause in the BOE’s most aggressive rate-tightening cycle in four decades.

Instead, traders are pricing in a hike to as high as 5.5% this year. In response, mortgage rates, which had eased after surging to 14-year highs in the market turmoil of last autumn, are rising again. Rates on the most popular mortgages are now above the 5% level the BOE has identified as a stress threshold for consumers.

“Headwinds to the housing market look set to strengthen in the near term,” Robert Gardner, chief economist at Nationwide Building Society, said after the lender reported a 0.1% drop in property values in May. Prices are now 4% below their peak last year.

Nationwide issued its report shortly before BOE data showed lenders authorized 48,690 home loans in April, 6% fewer than in March. Households repaid £1.4 billion of mortgage debt in April, the weakest month excluding the pandemic on record.

What Bloomberg Economics Says...

“The unexpected drop in mortgage approvals adds to evidence the correction in the UK housing market has some way to go. The recent rise in borrowing costs will also reduce the demand for mortgages ahead.”

—Niraj Shah, Bloomberg Economics. Click for the REACT.

Meanwhile, mortgage lenders have started to pull cheap deals from the market in anticipation of higher borrowing costs, in an echo of the budget crisis that wrecked Liz Truss’s short-lived premiership.

According to data provider Moneyfacts, lenders have withdrawn close to 800 residential and buy-to-let mortgage products in a matter of days.

The prospect of rising borrowing costs has even revived talk that Britain could slip into recession, a threat to Sunak and the Conservatives.

Nor will a modest fall in house prices do much to help those unable to get onto the housing market after a decades-long housing boom. Affordability is particularly stretched in London, where prices paid by first-time buyers are around nine times their average salary.

Read more:

- IMF Upgrades UK Growth But Warns Rates May Need to Rise More

- UK’s Record Migration May Have Boosted Home Rental Costs by 7%

- BOE Raises Key Rate to 4.5%, Signaling More Hikes May Follow

- UK’s Stubbornly High Inflation Fuels Bets for Higher Rates

(Adds attribution in second paragraph.)