The leadership upheaval at NatWest Group Plc sparked by the Nigel Farage account controversy now risks delaying the UK government’s plan to sell the remainder of its stake in the lender it rescued during the global financial crisis.

After the shock exit of Alison Rose last month, NatWest named its former head of commercial lending Paul Thwaite as interim chief executive officer for an initial period of 12 months. Several candidates, including Thwaite, are being considered for the role of permanent CEO, and the Edinburgh-based bank aims to first name a replacement for Chairman Howard Davies by Christmas, about six months earlier than schedule, according to people familiar with the matter.

The uncertainty was partly created by ministers, with Davies saying alongside NatWest’s second-quarter results that Rose had to go after the government made it clear it wanted that outcome.

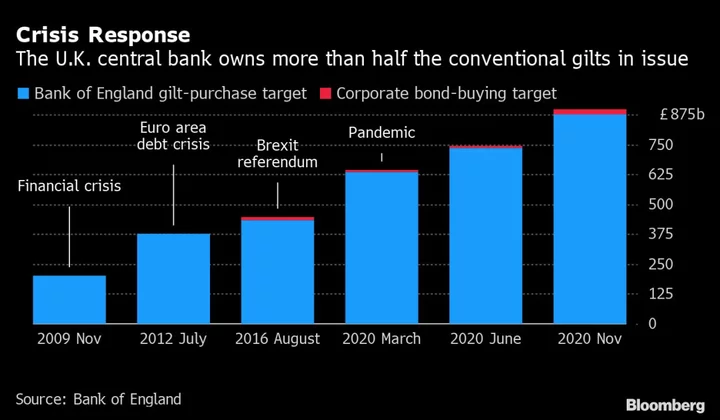

But that leadership vacuum may now turn out to be a headache for ministers, who may find it difficult to further pare taxpayers’ holdings in NatWest — currently at about 39% — while the bank doesn’t have a firm new leadership team installed. The UK still remains NatWest’s biggest shareholder about 15 years after bailing out what was then Royal Bank of Scotland in a £45.5 billion ($58 billion) rescue.

“Recent management changes at NatWest, with the search for a new CEO, cloud the investment case for the bank,” said Philip Richards, senior banking analyst at Bloomberg Intelligence. “That could delay the sell-down of the government’s stake.”

Taken together with other regulations, ranging from government actions on lending to savings rates, it all “adds to the uncertainty” for investors, Richards said. Shares of NatWest have declined about 26% since the end of January.

The government intends to stick to its plan of fully disposing of its shares in NatWest by 2026 and won’t comment on the timing of sales, a representative for the Treasury said in an email.

Abrupt Exit

Rose stepped down on July 26 after the government signaled her position became untenable following the furor kicked up by the way NatWest’s Coutts subsidiary said it would close the accounts of Farage, the former Brexit-campaigner-turned-political pundit.

It was an abrupt departure for one of the City of London’s most prominent executives, who was the first and only woman to run one of Britain’s largest lenders. The public row has also complicated the bank’s search for the next leaders.

Whoever fills Rose’s shoes will face the challenge of managing the relationship with the government as well as private investors. Their task includes winning new shareholders when the state eventually disposes of more of its holdings.

It’d be prudent to wait until it’s clear who will be picked to replace Davies as chair and how the varying interests of stakeholders will be managed, one person told Bloomberg News. The person, named by several people in the City as a credible candidate, said they would delay showing interest until factors are clear, asking not to be identified discussing NatWest’s executive search plans.

New leaders will have to deal with politics, according to Andre Spicer, executive dean of the Bayes Business School in London. Anyone running a big retail bank will face government interest, but the large ownership stake in the case of NatWest “ups the ante,” he said.

Among the external figures who could be considered for CEO of NatWest are Francesca McDonagh, who joined Credit Suisse last year and was previously the boss of Bank of Ireland; Debbie Crosbie, the head of Nationwide Building Society; and Matt Hammerstein, UK chief of Barclays Plc, people said, asking not to be identified discussing NatWest’s executive search plans.

Chair Candidates

Head hunter Spencer Stuart is working with NatWest to find a replacement for Chairman Davies. Names circulating include William Vereker, chair of Banco Santander SA’s UK operation and a former investment banker who had a stint in government as Theresa May’s business envoy; John Kingman, a former Treasury mandarin who is now chairman of Legal & General Group and the UK arm of Barclays; and L&G’s chief executive Nigel Wilson, who is leaving at the end of the year, the people said.

Other prospects are Richard Meddings, chair of NHS England and former chair of TSB Banking Group, and George Culmer, chairman of Aviva and the former chief financial officer of Lloyds Banking Group, some of the people said. Christine Hodgson, chair of Severn Trent and a former director of Standard Chartered, and Alison Brittain, former CEO of Whitbread and previously retail banking boss of Lloyds, could also be approached, the people said.

Spencer Stuart and NatWest, where senior independent director Mark Seligman is leading the process, did not comment. The potential candidates either did not respond to requests for comment or declined to say anything about the role.

Process Review

NatWest has also hired law firm Travers Smith for an independent review of its handling of Farage’s account. Its interviews and scrutiny of processes — due to take place in the next few weeks — could lead to more disruption, the people said. The law firm will then look more widely at Coutts’ account-closing processes.

The lender has pledged to make the findings public, which may happen late this year. That risks triggering more departures from the bank, as well as raising questions about Rose’s exit package, after Davies said it would be partly determined by the outcome of the investigation.

The reaction of many when the Farage affair blew up was a shudder: that it could have been their own institution caught in the cross-hairs of a political fight. But there was also a view that it was a particular bear-trap for NatWest, given the eye its management has to have on the view in Westminster.