Soft power and past glories will be among the UK’s tools when it gathers the world’s titans of finance to a summit to boost much-needed investment in the country.

Both Buckingham Palace and Hampton Court will be the venues for the starry names on the guest list. Blackstone’s Stephen Schwarzman will speak alongside Prime Minister Rishi Sunak, while Jamie Dimon, chief executive of JP Morgan Chase, and David Solomon of Goldman Sachs are jetting in. From the UK, the bosses of Lloyds, Barclays, HSBC and Aviva are coming alongside leaders from tech and fashion.

But as the government gets ready to put on a show, which will also include King Charles, business leaders are hoping the prelude to the Nov. 27 event will be concrete tax changes that encourage investment.

Such measures are high up on their wish list when Chancellor of the Exchequer Jeremy Hunt announces new fiscal plans on Wednesday. And if they happen, it will give Sunak something on which to hang his sales pitch days later.

Read more: Hunt Warns on Inflation Risk as UK Tax Cut Expectations Grow

Business & Trade Secretary Kemi Badenoch will lean on the UK’s historic achievements in a bid to set ambitions high as she kicks off the event.

Over the centuries Hampton Court — southwest of London — has hosted William Shakespeare and Isaac Newton, and been the venue for meetings about exploration of the new world, Badenoch is considering telling guests, according to a person familiar with the matter.

Yet the lofty rhetoric contrasts with a difficult picture. The UK is still able to attract much of the foreign direct investment flowing into Europe, especially in sectors with high value jobs, but France has held the top spot for four years, which it took from the UK, according to the EY 2023 UK Attractiveness Survey.

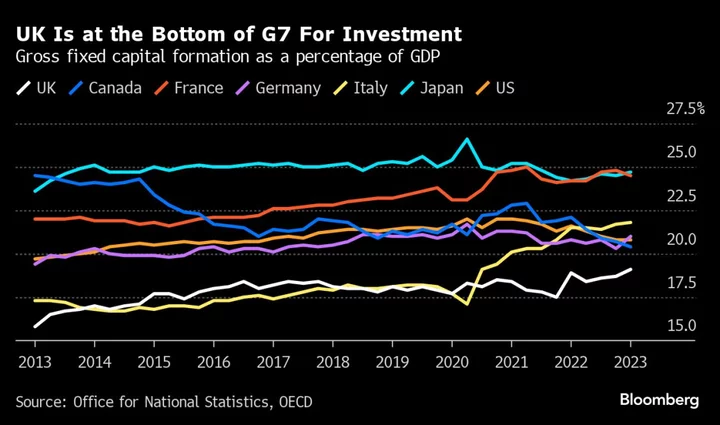

Overall, FDI into the UK has fallen by more than 25% since 2016-17, government statistics show. Investment as a percentage of output has consistently lagged behind other Group of Seven nations.

Jarring Message

Many businesses complain about a lack of consistent policies, such as the jarring message sent by the government’s cancellation of part of a long-planned high-speed rail link.

Fights over Brexit and chaos within Sunak’s Conservative Party are adding to the challenges, as internal divisions have led to a rotation of ministers in and out of key positions.

Meanwhile, other countries are also on a mission to lure money. Just this month, Chinese President Xi Jinping made a fresh pitch during a visit to the US. Among the attendees at an exclusive dinner in San Francisco were Schwarzman of Blackstone and BlackRock’s Larry Fink.

“International investors look at the UK and they see it is cheap, there is plenty of intellectual property,” said Simon French, managing director and head of research at Panmure Gordon. “But these competitive advantages are being eaten away at the edges. We are in a competitive game.”

If Sunak is hoping for a reset, it may start with Hunt’s Autumn Statement.

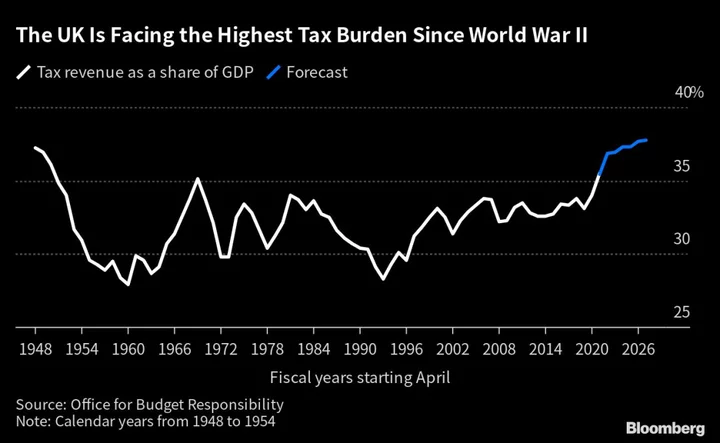

Businesses want him to make a tax break allowing 100% corporation tax relief on capital investment permanent, saying this would have a “transformational impact.” It would also help take the sting out of the decision to keep corporation tax at 25%.

Hunt’s big ask is for companies to deploy capital in the UK. According to Bloomberg Economics analysis, boosting public or private investment by 1% of GDP lifts economic output by about 2% in the long run.

Right now, economic trends have worsened, and the Bank of England expects the economy to flatline for the whole of next year.

Big Number

The investment summit is a copy of French President Emmanuel Macron’s “Choose France” event, which he first started in 2018 to nab business elites on their way to the Davos World Economic Forum in Switzerland.

Behind the scenes, officials are working furiously to announce a big number of new investments created at the event.

In 2021, when Boris Johnson as prime minister hosted a similar gathering at London’s Science Museum, the government said £9.7 billion was generated on the day itself, creating over 30,000 jobs. That number did not bear much scrutiny, according to an executive who was among the attendees.

But commitments and a clear plan for following through are crucial, according to Nigel Wilson, chief executive of Legal & General Group Plc, a UK insurer that has built one of the country’s largest investment arms in real world assets such as housing.

Johnson’s push was part of an agenda to “level up” the UK to address regional inequality. L&G created a Rebuilding Britain Index to measure progress.

“Many of these targets have been missed, such as in housing,” Wilson said. “But you have to have goals. That is what Legal & General has and it is how you get to be trusted as a partner.”

This time, there is a hope for specific commitments, with a range of business leaders expressing frustration about a lack of action and co-ordination within government. They also point to the enormous stimulus in America’s Inflation Reduction Act.

The UK had an early lead wind power, hydrogen and batteries, says Emmanuelle Bury, UK Country Head at BNP Paribas. To keep that, it needs to “maintain the momentum and de-risk private investments,” she said.

Such views are set to be voiced at Hampton Court, where senior industry figures will be present along with financiers.

Schmoozing opportunities will be as important as public events, and most of the cabinet are due to attend, according to people familiar with the matter. It will be a chance for senior bankers to meet clients, and for Middle Eastern investors to come together with businesses, the people said.

“It is very easy to pooh-pooh these investment summits, but there is something human about being in a room together,” said Panmure Gordon’s French. “They can move the dial, they are not just a talking shop.”

--With assistance from Jamie Nimmo.

Author: Katherine Griffiths, Philip Aldrick and Eamon Akil Farhat