The UK attracted its biggest-ever orderbook for a conventional bond sale on Wednesday as investors look to lock in high rates while they still can.

A sale via banks for £7 billion ($8.7 billion) of a new gilt maturing in 2043 attracted over £93 billion in orders, according to people familiar with the matter, with investors citing a relatively cheap valuation. That’s the highest demand for a UK bond, apart from a debut deal for green debt in 2021.

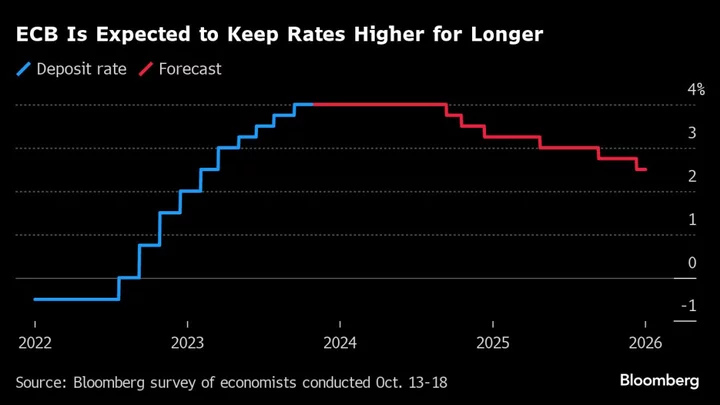

It’s the latest sign of strength in primary bond markets, with the European Union also attracting more than 13 times the orders for the debt on offer in a deal on Tuesday. Global bonds have been rallying on the prospect of central banks cutting interest rates next year, though yields for long maturity bonds remain near the highest in over a decade.

“The 20-year sector is somewhat of a sweet spot for demand,” said Megum Muhic, an analyst at RBC Capital Markets. Investors may have used this syndication deal to switch out of bonds with similar maturities “into the cheaper new issue,” he said.

The yield on 20-year gilts now trades around 4.6%, down from a peak above 5% last month.

The latest sale follows data showing inflation falling on both sides of the Atlantic, bolstering the case for an end to aggressive central bank rate hikes. UK inflation tumbled to the lowest level in two years, firming up bets that the Bank of England will be able to cut rates as early as the middle of next year.

Bookrunners on the sale are Barclays Plc, HSBC Holdings Plc, Lloyds Banking Group Plc, Morgan Stanley and UBS Group AG. The deal will price at 5.75 basis points above a 2042 gilt, which was the minimum level in initial price guidance.

(Updates with details, comment.)