The typical US homebuyer earns more money and is more likely to pay cash this year. And, increasingly, she is a single woman.

Facing limited home inventory, rising prices and high mortgage rates, house hunters were forced to increase their downpayment: For first-time buyers, it reached 8% of the total price, the highest rate since 1997, according to the annual Profile of Home Buyers and Sellers report from the National Association of Realtors.

In a sign of how tight the market has remained this year, recently sold homes were on the market for a median of just two weeks and typically went for 100% of the final listing price, matching the highest recorded since 2002.

The average homebuyer’s income jumped to $107,000 in 2023 from $88,000 a year earlier. Buyers are getting older, at 35 for a first house compared with 29 in the early 1980s, the report found.

Here are seven charts showing who bought and sold homes in 2023:

The share of recent buyers who were married couples dropped to 59%, the lowest since 2010, while unmarried couples’ have remained little changed in recent years at 9%.

Increasingly, buyers are single women. The portion of homes bought by single women and single men was roughly the same 40 years ago, but now the rate for women is almost double that of men. The typical single female buyer also tends to be a bit older: 38 for a first home, compared with 33 for single men.

Although this year saw a slight increase in the number of minority buyers, the vast majority remains White households. Black buyers accounted for 7% of the total, even though they represent almost 14% of the US population.

Before the Great Recession of 2008-2009, people stayed in their home for an average of about six years. Today, sellers are sitting on higher home equity and have held onto their houses longer, for a median of about 10 years.

With so many owners locked-in at low mortgage rates, people are reluctant to move unless that have to. Among the primary reasons to sell a house were being closer to friends or family, finding a bigger place or after a life change such as a divorce or having a child, according to the report.

About one in ten moved out because the neighborhood or school became less desirable.

As home values keep rising, people need to make more to afford one. About 20% of buyers paid cash in 2023, avoiding the punishing mortgage rates. That’s up from 13% in 2021, before interest rates started to rise.

“Given the erosion of housing affordability due to higher home prices and mortgage rates, the household income for those who successfully purchased homes jumped by nearly $20,000 and topped six figures for only the second time in our records,” said Jessica Lautz, National Association of Realtors’ deputy chief economist and vice president of research. The report has been published since 1981.

People aren’t moving as far from their previous home as they did in 2022, when remote work seemed like it might be a long-term possibility for many. Distance moved from the last home decreased from 50 miles to 20 miles, getting closer to the previous norm of 15 miles.

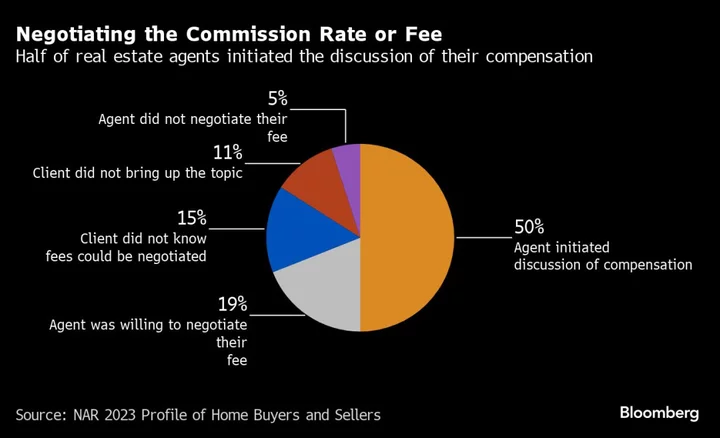

The broker commission system at the heart of the US residential housing market is opaque for many buyers who don’t realize the sales commission can be negotiated. The industry is facing unprecedented scrutiny about its commission-sharing system.

Around 80% of owners contacted just one agent when selling their home.