Inflation concerns are threatening to keep US Treasury yields higher for longer, worsening a slide in Asia stocks as investors sell chip shares after their recent rally.

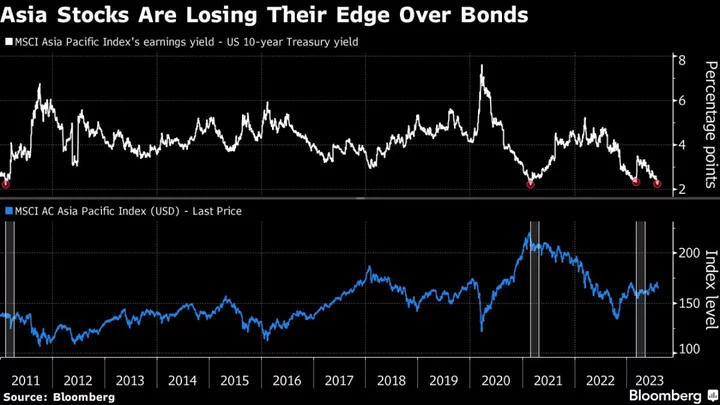

The spread on yields from earnings of MSCI Asia Pacific Index members over US 10-year notes dropped close to two percentage points earlier this month for only the fourth time in the past 12 years. Asian equities fell in the two months following each of the previous three instances, as valuations looked less appealing.

Treasury yields are being driven higher by a combination of the Federal Reserve’s determination to quash inflation by raising borrowing costs, and also by increase in supply to fund widening US budget deficits. The Fed has hiked its benchmark rate by more than five percentage points since early last year, fueling concern about a possible recession and damage to corporate earnings.

“What we would monitor is whether a sustained rise in US borrowing costs creates risk of a ‘credit event’ that may be a risk for the US economy as it would tighten credit growth,” Nomura Holdings Inc. strategists including Chetan Seth in Singapore, wrote in a recent note. “This scenario will also likely have some negative implications for Asian stocks.”

The US 10-year yield has climbed more than 70 basis points from this year’s low set in April to reach as high as 4.20% last week before pulling back to around 4%. There are plenty of catalysts for yields to start climbing again, including US inflation data for July due Thursday, and a renewed jump in oil and food prices.

A key bond-market gauge of expected US inflation is rising back toward a nine-year high, signaling concern the Fed will continue to wrestle with elevated price pressures for years. High inflation threatens to diminish the appeal of dividends in Asia, where the forward dividend yield of 2.8% is higher than in the US.

Asian stocks have also been coming under pressure as investors cut positions in chip and China shares, two areas which helped drive the region’s benchmark to its highest level in more than a year in July. Rising central bank interest rates are particularly bad for heavyweight tech stocks as they are seen to reduce the present value of future earnings.

Nomura is among the brokerages that expect the increase in yields to be temporary as investors return to haven Treasuries amid uncertainty about the US economic outlook. Meanwhile, forward earnings estimates have bottomed in Asia.

August is turning out to be a poor month for Asian equities, with all major gauges registering losses. The MSCI Asia gauge has dropped seven days out of the last eight, sliding 3.7% over the period.

Rising Treasury yields have have helped bolster the dollar this month, which is also a negative for overseas investors holding Asian shares. Institutional funds withdrew $2.2 billion from emerging Asia stock markets excluding China last week, the biggest net outflow since March.

(Adds dividend yield data in sixth paragraph.)