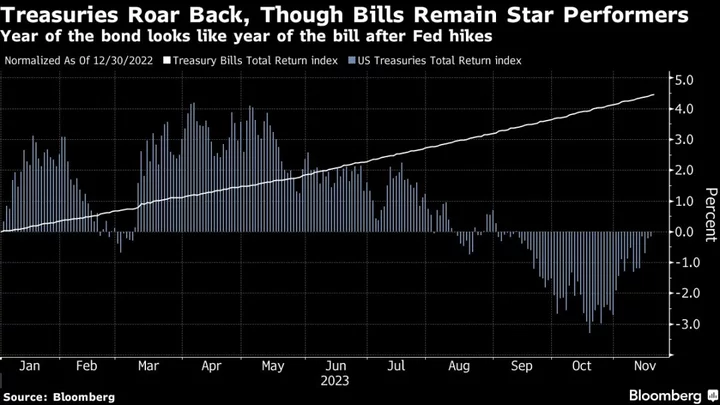

This year’s wild ride for the world’s deepest debt market may conclude with a happy ending as Treasuries soar this month to erase losses of as much as 3.3% in 2023.

The Bloomberg US Treasury Index rose 0.2% on Monday and is now back about where it ended 2022. Investors who anticipated that 2023 would be the “year of the bond” were instead hit by waves of turmoil as a resilient US economy prompted the Federal Reserve to extend its steepest tightening cycle for a generation.

Those losses have ended as slowing inflation and signs that the labor market is cracking encourage traders to bet that the Fed is done with hiking interest rates and that it will swiftly pivot toward reducing the benchmark rate in the first half of 2024.

“Growth momentum has peaked, inflation momentum has peaked and central bank tightening cycles are done,” said Andrew Ticehurst, a rates strategist in Sydney for Nomura Inc. “Yields are still much higher than they were, and there is room for rates to rally on risk-off developments.”

The $26 trillion market for Treasuries gyrated this year in a way normally more associated with riskier assets like equities. Implied volatility for the Treasuries market soared in March to the highest since the 2008 financial crisis, according to ICE’s MOVE Index.

The Bloomberg gauge of Treasuries climbed 2.8% this month, the most for any month since March. Traders switched from seeing 40% odds for another Fed hike, a position they held at the end of October, to pricing out increases and anticipating a rate cut by mid-2024, Fed funds futures show.

Treasuries roared to a 3.1% gain as of Jan. 18, the best start to any year since at least 1988. The index then erased that advance before the end of February as strong jobs and inflation data boosted expectations for Fed hikes. The banking crisis in March then kicked off an even stronger rally that took the index to a peak return of 4.2% by April. Since then, Treasuries posted a six-month losing streak that was the longest-such slide since 2011.

Even a flat year might be a welcome respite for bond investors, after Treasuries lost a record 12.5% in 2022, following a 2.3% hit the year before. A strategy of merely holding Treasury bills has earned 4.5% this year.