The US Treasury is set this week to begin a ramp-up in issuance of longer-dated securities that’s likely to stretch into next year, forced by a rapidly deteriorating budget deficit and soaring interest rates.

For the first time since early 2021, the Treasury will boost its so-called quarterly refunding of longer-term Treasuries, to $102 billion from $96 billion, the consensus among dealers suggests. While down from the record levels hit during the Covid-19 crisis, that’s well above pre-pandemic levels.

Wednesday’s announcement will likely also see debt managers hoist regular auction sizes for securities across the yield curve — with potential exceptions or smaller bumps for notes less in demand. Dealers will be on watch separately for an update on a coming program to buy back older Treasuries.

Public borrowing needs are on the rise thanks in part to Federal Reserve rate hikes that have taken its policy benchmark to a 22-year high — in turn driving up yields on government debt, making it more costly. The Fed is also shrinking its holdings of Treasuries, obligating bigger government sales of them to other buyers. It all raises the risk of bigger volatility swings when the government auctions its securities.

“There’s just a lot of supply coming,” said Mark Cabana, head of US interest-rate strategy at Bank of America Corp. “We’ve been surprised by the deficit numbers, which are sobering.”

Larger amounts of debt issuance haven’t translated directly into lower prices and higher yields, as the swelling in US debt alongside historically low yields attests over the past two decades. But bigger auction sizes contribute to the potential for short-term volatility, at a time when banks have diminished appetites for market making. That was on display in a seven-year auction on Thursday that saw buyers demand a bigger discount to absorb the securities.

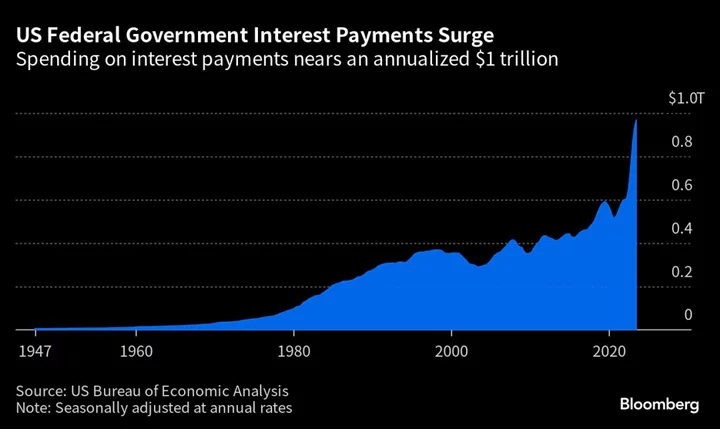

What has sent yields higher is Fed rate hikes and inflation, a key dynamic widening the budget deficit. The cost of servicing US government debt jumped by 25% in the first nine months of the fiscal year, reaching $652 billion — part of a global phenomenon propelling public borrowing.

Read more: US Racks Up $652 Billion in Debt Costs as Rates Hit 11-Year High

Cabana and his team forecast the Treasury will bump up sales of coupon-bearing debt — as notes that pay interest are known — not only this month, but again in the November and February debt-management policy announcements.

The consensus of dealers’ projections shows the following for the upcoming refunding auctions:

- $42 billion of 3-year notes on Aug. 8

- $37 billion of 10-year notes on Aug. 9

- $23 billion of 30-year bonds on Aug. 10

Beyond those sales, most dealers see a lift in issuance across most maturities at a clip of $2 billion each, with many seeing smaller increases for 7- and 20-year Treasuries, which have seen bouts of poor demand.

Some dealers predict the 20-year bond will be singled out for no change in size. That security has been plagued by weak pricing and liquidity since the Treasury relaunched it in 2020.

“There should be well-distributed auction increases across the curve,” besides slightly smaller ones for the 7- and 20-year debt, said Subadra Rajappa, head of US interest rates strategy at Societe Generale SA. “It’s a one-way trajectory now for the deficit over the next 10 years, with them getting larger. Treasury wants to makes sure they are well funded for the next several years.”

The federal deficit hit $1.39 trillion for the first nine months of the current fiscal year, up some 170% from the same period the year before, showcasing the Treasury’s burgeoning funding needs. On Monday, the department boosted its forecast for borrowing in the July-to-September quarter to $1 trillion, from the $733 billion it penciled in in early May.

Read More: US Treasury Boosts Quarterly Borrowing Estimate to $1 Trillion

What Bloomberg Intelligence Says...

“Coupon Treasury issuance may be slowly increased over the next six months.

“Coupon auctions could climb by $1 billion across the curve in August, with monthly auctions rising an additional $1 billion each month through January.”

— Ira F. Jersey and Will Hoffman, BI strategists

Click here to read the full report

Meantime, the Fed is shrinking its holdings of Treasuries by up to $60 billion a month, by letting securities mature without replacing them. Fed Chair Jerome Powell last week also signaled that the portfolio runoff could continue at some pace even after policymakers had begun cutting interest rates, suggesting a longer period than many had thought for the so-called quantitative tightening program.

Another dynamic for Treasury’s managers to consider is the share of bills, which mature in short-term spans of up to a year, in overall debt outstanding. The Treasury Borrowing Advisory Committee, a panel of market participants including buyers and dealers, has long advised a 15% to 20% range for that ratio.

The Treasury lately has been selling a barrage of bills as it sought to rebuild its cash balance in the wake of running it down to dangerously low levels during the partisan battle over the debt limit earlier this year.

Citigroup Inc.’s team said the targeted T-bill share of debt will be among the things they’re looking for this week.

Bills, Buybacks

“Treasury needs to materially increase auction sizes at the November and February refunding,” Citigroup’s Jabaz Mathai, head of Group of 10 rates strategy also said in a note to clients. The later-quarter increases are set to be at “a quicker pace than the post-Covid issuance cycle,” he added.

Another item to watch will be any update to the Treasury’s plans for buybacks, which they first unveiled in May after months of consideration. One of the aims of buying back older securities and issuing more of the current benchmarks is to help bolster patchy liquidity in the Treasuries market. Another is to smooth out volatility in its issuance of T-bills.

The program is set to start next year, but dealers see the Treasury as still working out the details. The department queried them about again in their pre-refunding survey questions.

Read More: Treasury Asks Dealers About Auction Size Growth, Buyback Design

--With assistance from Viktoria Dendrinou, Alex Tanzi and Elizabeth Stanton.

(Updates with quarterly borrowing estimate, in first paragraph after second chart.)