Topgolf Callaway Brands Corp. tumbled on Thursday after weaker-than-expected sales trends at its namesake chain of high-tech driving ranges spurred two Wall Street analysts to downgrade their ratings on the company.

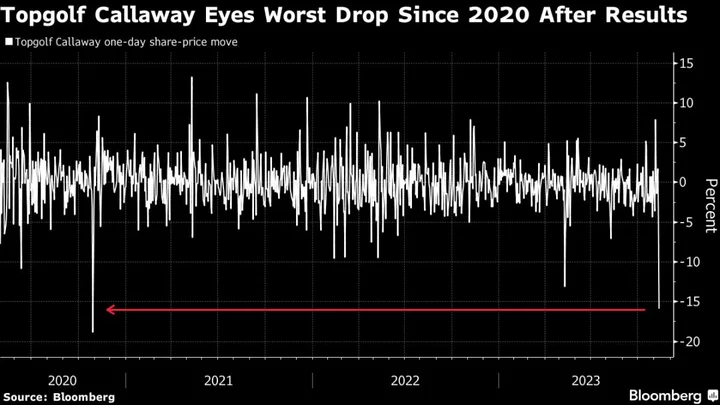

Its shares slid as much as 19%, putting the stock on track to suffer its worst one-day drop since October 2020. After the market closed on Wednesday, the golf-equipment company said Topgolf same-venue sales declined 3% year over year in the third quarter due to softer-than-expected demand, as well as extreme heat that impacted venues in southern markets. It also lowered its full-year projections for Topgolf same-venue sales growth, total revenue and adjusted Ebitda.

The disappointing update prompted Stephens Inc. and JPMorgan Chase & Co. to downgrade Topgolf Callaway to hold-equivalent ratings, while several other firms also cut their price targets for the stock. The pair of downgrades brought Topgolf Callaway’s consensus rating — a proxy for its ratio of buy, hold, and sell ratings — to about 4.2 out of five, the lowest since early 2016.

“We continue to believe that Topgolf is undervalued within Topgolf Callaway Brands today, but with softer near-term expectations we don’t see a near-term catalyst for unlocking value,” Stephens analyst Daniel Imbro wrote in a note to clients Thursday.

Topgolf Callaway Chief Executive Officer Chip Brewer said during the earnings call that corporate event demand has cooled after a post-pandemic surge, and customer traffic trends have softened during the week, with the exception of Tuesdays, when Topgolf typically offers discounts.

JPMorgan analyst Matthew Boss flagged in his downgrade that consumers’ price perception of Topgolf has “deteriorated significantly,” according to its HundredX consumer insights data, with the October update marking the worst reading in the three-year data set.

In June 2021, shares of the company touched the highest level since 1997 after golf enjoyed a renaissance moment during the Covid-19 pandemic. The stock has slid since then, and had already dropped 37% this year through Wednesday’s close.

“This is painful to step to the sidelines after the performance year to date and our belief that the intrinsic value of the Topgolf asset is not appreciated today,” said Imbro. “However, as Topgolf sales continue to slip, we don’t believe the asset, or the core golf earnings, are going to command a higher multiple in the near term.”

--With assistance from Joel Leon.