By Chris Taylor

NEW YORK When Valentina Valentini was putting together gift ideas for her wedding, the freelance journalist quickly realized that a traditional registry would not work.

With an apartment in London but a ceremony in California, the newlyweds would either need to fly across an ocean with a ton of stuff, or have it all shipped and pay expensive import taxes.

"We live in a small flat, and don't need a lot of things," said the 39-year-old. "Physical gifts did not make sense for us at all."

One thing the couple wants, though, is a home of their own.

So they asked guests at their 2022 wedding to contribute to their savings, currently in a certificate of deposit, as they work towards buying a dream home with a porch in her native New England.

It is a common scenario. In a new survey from Realtor.com, among couples who have created a wedding registry in the last two years, an eye-popping 85% said they would have preferred cash towards a down payment on a home, instead of typical registry gifts.

"It makes sense that couples getting married would prefer money for a down payment, over china they will never use or a blender they don't need," said Clare Trapasso, executive news editor for Realtor.com. "They are looking at near-record home prices, on top of mortgage rates hovering around 7%."

Indeed, if newlyweds could do their registry over again, 80% told Realtor.com they would include an option to contribute to housing-related items like a down payment, monthly mortgage or closing costs.

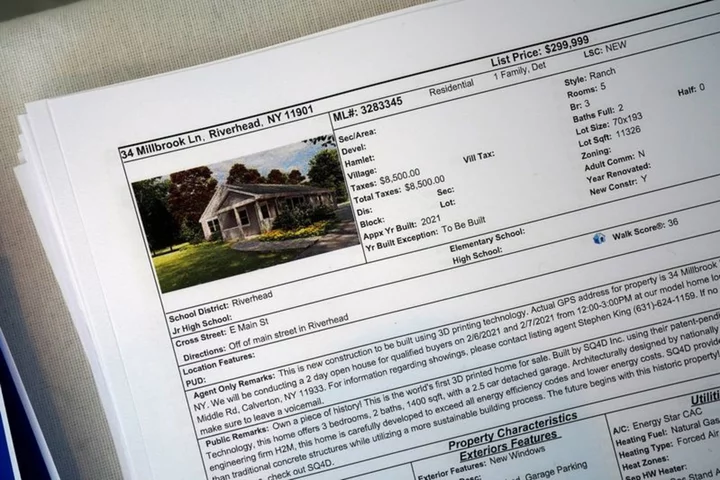

The trend is a simple reflection of the nation's housing market: Prices have risen so much in recent years that more than 75% of homes on the market are unaffordable for middle-class buyers, the National Association of Realtors said.

While asking for cash gifts makes financial sense, it is tricky. Weddings involve a lot of tradition after all, and guests may be unfamiliar or uncomfortable with the idea.

Here is how you ask for money instead of stuff.

DESCRIBE THE RATIONALE

Since this is a relatively new concept for many people, you may have to walk them through it. You can do this in the save-the-date packet, official invitation and on your wedding website.

"We mentioned all the logistics and expenses involved with shipping, and that we were going to be asking for monetary gifts instead," Valentini said. "We would much rather have cash to put towards savings."

Be as specific as you can: The idea of chipping in for a couple's first house may be more emotionally compelling to people than contributing to a general pot of savings.

GIVE GUESTS THE CHOICE

Some wedding attendees may want to opt for a more 'traditional' gift, despite what the couple may desire. In fact, 70% of them still prefer that, the Realtor.com survey showed.

So rather than forcing invitees into one camp or the other, let them decide.

"I would say give people options on the registry," Realtor.com's Trapasso advised. "Put a few traditional gifts on it, which they can purchase for you. But also put an option for a honeymoon fund or a homebuying fund, if they would prefer to do that."

PUT IT TO WORK

Whatever does get donated to your down payment fund, it likely will not be enough to pull the trigger on a purchase right away. And, in fact, it is still such a foreign concept to many people that you might raise less than you expect, Valentini said.

As you build up those savings, make sure to put it in the right account – such as high-yield savings, or a CD, or a money market fund where you can currently earn 4-5% annually while you wait.

That way, even if the right housing purchase does not present itself, you can still use that growing cash stash to put you on secure financial footing for years to come.

"Use it to create an emergency reserve, pay down student loan debt, or fund an IRA contribution," said financial planner Randy Bruns of Naperville, Illinois. "This is a very practical idea for wedding gifts – and one that we have chosen for my sister-in-law's upcoming wedding."

(Editing by Lauren Young and Richard Chang)