What do a Bugatti supercar, a Hilton hotel and the Chagos Islands have in common?

They all feature on a long and increasingly bizarre list of stories behind the financial crisis sweeping Britain’s local authorities.

While there’s been a steady dribble of so-called Section 114 notices from councils declaring effective bankruptcy in recent years, Birmingham City Council’s filing this week caused the most alarm.

For Europe’s largest local authority, a legal battle over equal pay is proving a huge drain on resources. Its leaders conceded on Tuesday it faces “unprecedented financial challenges” with all new spending, except on core services, stopped in a bid to right the ship.

Britain’s second city faces a bill as high as £760 million ($948 million) after a Supreme Court ruling from 2012 backed a group of largely female employees who missed out on bonuses that were given to staff in traditionally male-dominated roles at the council. The council has already paid out £1.1 billion on the claims.

But Birmingham also blamed surging demand for social care, inflationary pressures and “dramatic reductions” in revenue from business taxes. Councils have borrowed over £133 billion combined, and the fallout is turning into yet another headache for Prime Minister Rishi Sunak ahead of expected elections next year.

Austerity

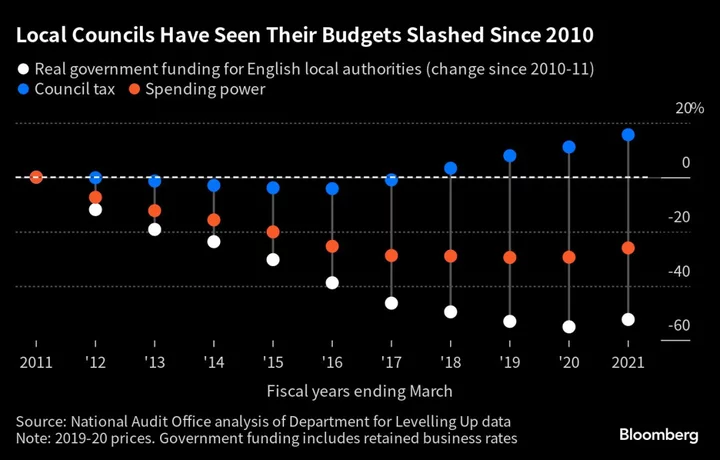

The situation is symptomatic of a broader crisis. Just as with the crumbling concrete in British schools and capacity constrains in the National Health Service, some people argue that the trouble at councils is a legacy of cuts made when the Conservatives took power 13 years ago.

The austerity era started by David Cameron’s coalition was brutal for local councils with central grants slashed 40% in real terms over the 2010s, according to the Institute for Government.

In the face of budget cuts, some councils chose to roll the dice. Many borrowed to top up income, and invested in shopping centers, offices and airports — policies that the Treasury has now clamped down upon.

Skyscrapers and Solar Farms

Woking Borough Council, in a commuter town close to London, issued a Section 114 notice in June after a debt-fueled spending spree.

The investments centered around its Victoria Square project, which included skyscrapers and a Hilton hotel. Local leaders said the council was even responsible for purchasing the Hilton Hotel’s cutlery.

Last autumn, meanwhile, Thurrock Council in Essex admitted it was in financial distress after investment losses of at least £275 million. Reports by the BBC and Bureau of Investigative Journalism said public money invested in a solar farm company was then spent on a country estate, private jet and Bugatti supercar.

Also last year, Croydon Council issued its third Section 114 notice in two years as it struggled to get to grips with what it called “toxic” debt problems.

More section 114 notices could be coming down the track with eye-watering levels of debt at some councils. Sigoma, a group representing local councils in some poorer areas, warned last month that almost a third of its members are considering declaring effective bankruptcy over the next few years.

“I think it’s likely there will be more,” said Tony Travers, a professor at the London School of Economics. “Councils are spending probably, on average, about 15% less in real terms than they were back in 2010, and in that time, the population of the country has grown substantially and the number of older people has increased significantly so the demands on services are going up.”

Islanders

Crawley Borough Council warned the government last year that it faced a funding crisis if forced to house a large number of people originally from the Chagos islands amid a dispute between Britain and Mauritius. Local leaders in Crawley — already home to a community of 3,000 Chagossians — fear that it will likely attract more arrivals seeking British citizenship.

A housing crisis is also threatening Hastings, a seaside town in East Sussex. A report into the council’s finances by the Local Government Association earlier this year said that it could issue a section 114 notice partly due to costs from homelessness and temporary accommodation.

Woking and Thurrock are among those that have racked up the most amount of debt per capita. Government data reveals that local authorities in Spelthorne, Warrington, Barking & Dagenham and Aberdeen have also amassed borrowing of over £1 billion — just as global borrowing costs started to soar.

--With assistance from Andrew Atkinson and Eamon Akil Farhat.