Asian central banks are seen to raise interest rates over the next six months, with a stronger dollar and rising oil prices keeping countries from Australia to Indonesia and South Korea on a tightening path.

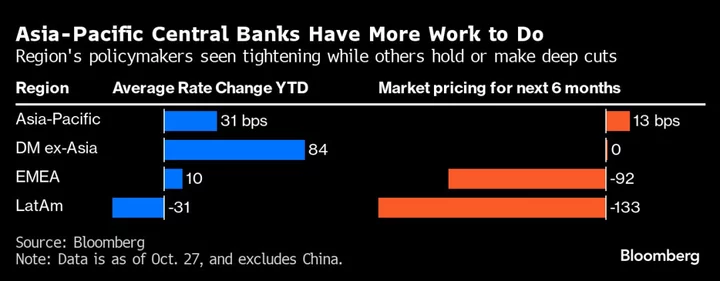

Traders see an average 13 basis points of hikes in the Asia-Pacific region, excluding China, over the period, according to market implied policy rates. That compares with bets that rates will remain unchanged in developed markets excluding Asia while hefty cuts are seen in Europe, the Middle East and Africa as well as Latin America.

Central banks in Indonesia and the Philippines already raised interest rates in recent weeks and signaled they could tighten again. Other Asian monetary authorities, including India, are so far choosing to run down their foreign currency reserves instead, but economists say there’s a limit to how long that can continue.

The “double whammy” of a weak currency and inflation resurgence could see some central banks in Asia return to tightening, said Radhika Rao, a senior economist at DBS Bank Ltd. “Persistent and outsized depreciation pressures could convince central banks to resume rate hikes,” she said.

In 2023 so far, central banks in Asia-Pacific have, on the average, increased interest rates by far less than their developed market counterparts, according to Bloomberg data.

The divergence between US and Asian interest rates has “blown extra wind into the sails of the greenback,” Frederic Neumann, chief Asia economist at HSBC Holdings Plc, said on Oct. 27. “Although many factors affect exchange rates, interest rate differentials remain among the most important, and any central banker worried about further FX volatility will think hard about letting local rates deviate too sharply from US rates.”

“Further moves yet by the Fed, or another spike in market rates, could tip others into tightening again, too, from Korea to India,” Neumann said. “Or, at the very least, it would complicate plans for further easing” in places like China and Vietnam.

Here are major Asia-Pacific central banks where tightening is still on the cards:

Australia

The Reserve Bank of Australia will meet on Nov. 7 with economists at the country’s four biggest banks predicting a 25 basis point rate increase that will take the cash rate to 4.35%, a level not seen since November 2011. Expectations for a hike gained momentum after third-quarter inflation was stronger than forecast, just a day after Governor Michele Bullock said she “will not hesitate” to increase rates further if there’s a material upgrade to the bank’s inflation outlook.

Indonesia

In recent weeks, Bank Indonesia saw how fast the calculus can change for Asia’s policymakers. After repeatedly signaling a rate pause — or even a cut — the central bank delivered a surprise quarter-point hike on Oct. 19 as the Israel-Hamas war further weakened the rupiah.

Indonesia is much more sensitive than its neighbors to currency swings due to the nation’s exposure to foreign fund flows. The central bank isn’t ruling out an unscheduled rate increase, its spokesman said last week, though the possibility was “very small.”

Japan

A majority of economists in a Bloomberg survey expect the Bank of Japan to embark on policy tightening by April as bond yields edge closer to 1%, the de facto ceiling under the bank’s yield curve control program.

Malaysia

Bank Negara Malaysia is under pressure to raise borrowing costs after the ringgit recently hit its lowest level since 1998, during the Asian financial crisis. The central bank’s key rate has stayed at 3% since July, putting it at a record discount relative to the Federal Reserve’s rate.

“Bank Negara Malaysia’s challenge is most stark given persistent MYR depreciation pressures,” said Lavanya Venkateswaran, senior Asean economist at Oversea-Chinese Banking Corp Ltd. “BNM will remain hawkish and entertain the possibility of rate hikes if inflationary pressures, particularly on core inflation, build up next year.”

Most economists say the bar is high for the central bank to resume tightening amid cooling inflation and economic growth risks. The central bank’s next interest rate decision is scheduled for Nov. 2.

Philippines

The Bangko Sentral ng Pilipinas delivered an off-cycle rate hike on Oct. 26 to help rein in inflation that’s at risk of breaching a 2%-4% target for a third straight year in 2024.

The Nov. 16 policy meeting will proceed as scheduled, where Governor Eli Remolona has said further tightening would be considered. The BSP “fell a little bit behind” after it decided not to raise the rate at the September meeting when inflation risks have already increased, according to the governor.

South Korea

The Bank of Korea already has a terminal rate forecast of 3.75%, up from 3.5% currently and Governor Rhee Chang-yong could deliver a so-called insurance hike to stem inflation expectations, economists say.

Taiwan

Economists expect Taiwan’s central bank, called the Central Bank of the Republic of China or CBC, to opt for further increases if higher oil prices drive inflation significantly above its outlook.

“This could occur after the presidential election in January 2024,” said Jeong Woo Park, an economist at Nomura Holdings Inc. “If inflation remains far above the CBC’s 2% target, and global financial conditions tighten further, we would expect the CBC to resume its hiking cycle, raising the policy rate to 2.125% from 1.875% currently.”

Thailand

The Bank of Thailand signaled in September that it has done enough after eight straight interest-rate increases that took borrowing costs to a decade high. But while inflation is below target, the baht is among the worst performers in the region over the past three months, and rising oil costs and higher government spending may revive price pressures.

Policymakers said they will take a closer look at risks stemming from tensions in the Middle East at the next meeting scheduled Nov. 29.

--With assistance from Anisah Shukry.

Author: Swati Pandey, Claire Jiao and Garfield Reynolds