In the boardrooms of Corporate America, one big fear has been palpable for more than a year now: That surging interest rates are set to wipe out earnings, cap stock prices and kill off investment.

Yet with the S&P 500 netting its best week since June after a month-long anxiety attack, equity traders are once again shrugging off the highest borrowing costs in more than two decades. A good reason: While interest expenses are on the rise, they remain near the lowest levels since 2009.

It’s a whiplash in the bearish narrative that the hawkish Federal Reserve will doom America’s famous profit engine.

Yes, equity and credit investors will feel the refinancing pain ahead if rates stay elevated. Yet for now, companies are still in good shape to cover their interest expenses with their firepower from earnings, going by a Bloomberg Intelligence analysis of trailing four-quarter reports that encompass their most recent results.

“There’s a lot of talk about rising net interest expenses and debt levels,” said BI’s Gillian Wolff. “But given that interest-rate coverage ratios started from such a strong point at the end of 2022, it will take some time before these rising expenses become problematic.”

The S&P 500 jumped 2.5% this week and the Nasdaq 100 climbed even more, aided by reports showing everything from wage growth to consumer confidence cooled just enough to boost the Federal Reserve’s policy stance, without portending a recession.

And consider net interest expenses S&P 500 companies, excluding financials and real estate companies, divided by their earnings before interest and tax. A lower reading suggests firms have enough profits coming in to cover their immediate interest expenses. The good news is that, though the ratio is rising at 8.05, it remains near record lows since 2009.

A big reason for this is that Corporate America took advantage of historically low interest rates over the past decade. About a third of the debt in an index tracking investment-grade corporate bonds have maturities of 10 years or more, according to calculations by Bloomberg’s Cameron Crise.

And many Americans did the same, locking in lower rates for things like car and home loans. More than 40% of all US mortgages were originated in 2020 or 2021, when borrowing costs were at historic lows. Meanwhile data from the New York Fed show that about 89% of consumer debt is shielded from fluctuating interest rates.

“Monetary policy does not seem like it’s taking a big bite,” says Art Hogan, chief market strategist at B. Riley Wealth. “And the reason it’s not taking a big bite on the corporate side is clearly the fact that corporations took advantage of low interest rates and long duration of debt.”

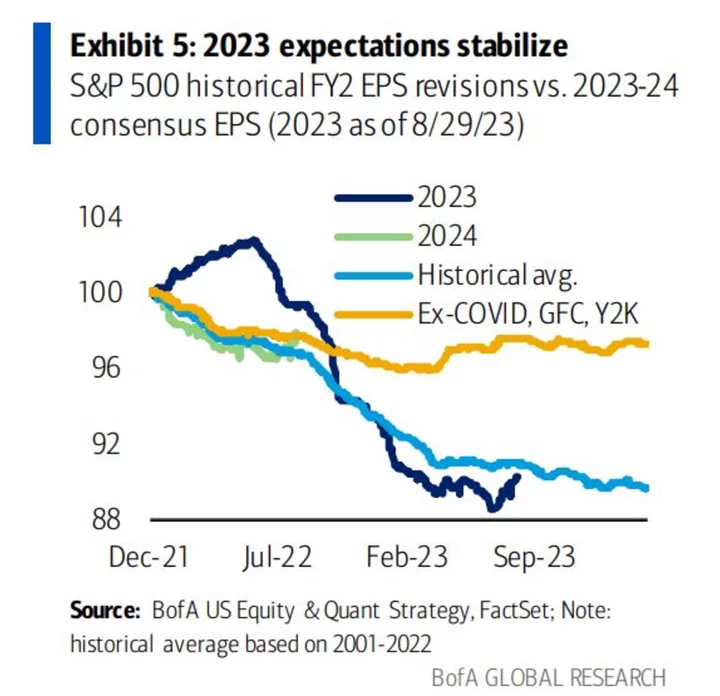

S&P 500 companies beat earnings by 3% during the second quarter, with margins driving beats across most sectors, according to a Bank of America Corp. team led by Savita Subramanian. In addition, expectations for the year have stabilized, revisions turned positive and the global revision ratio is at a level that gives succor to bulls, they wrote in an Aug. 31 note. Put another way, the second quarter has likely marked a trough in earnings.

Still, the pain may just be postponed. Cheap financing plays a huge role driving stock rallies, according to a June paper by Michael Smolyansky, an economist in capital markets for the Fed. Along with falling tax rates, shrinking interest expenses accounted for more than 40% of the profit growth in the S&P 500 during the 20 years through 2019, Smolyansky wrote.

That conceivably creates a dour outlook for the future of earnings and share prices. “Simply put, there is very limited scope for interest rates to fall much below their 2019-levels — and, of course, interest rates have since risen substantially in the wake of elevated inflation readings,” Smolyansky wrote.

Most businesses were able to lock in at historically low rates over the last 15 years and are now able to earn more competitive rates of return without taking on too much risk. That’s helping the economy, earnings and consumers, says Michael Arone, chief investment strategist at State Street Global Advisors. But reality may come to bite eventually.

“What the market is thinking is, ‘by the time they have to refinance, the Fed will be cutting rates and rates will be lower’ — I’m not so sure,” he said. “That’s a risk, but probably not a risk for today. It’s probably at least a few quarters away.”

--With assistance from Alex Tanzi.