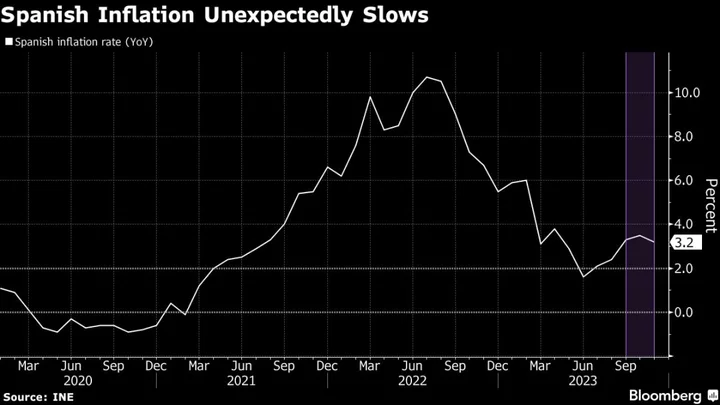

Spanish inflation unexpectedly eased, retreating for the first time since June thanks to drops in the costs of fuel and tourism.

Consumer prices rose 3.2% from a year earlier in November, data Wednesday showed. That compares with 3.5% the previous month and defied the median estimate in a Bloomberg survey of economists for an acceleration to 3.7%.

A gauge of underlying pressures that excludes energy and fresh food fell to 4.5%, easing much more than anticipated.

The numbers, the first for this month from a major euro-zone economy, offer a glimpse into how inflation is faring with European Central Bank interest rates now on hold following an unprecedented bout of hikes.

Germany, the continent’s biggest economy, will release figures later in the day that are expected to reveal a slowdown to 2.5%. Analysts reckon price gains in the 20-nation euro area as a whole moderated to 2.7% — nearing the ECB’s 2% target. That report is due Thursday.

Spain actually saw inflation drop below the ECB’s goal in the first half of 2023, though it later rebounded. That was largely down to base effects that are set to persist as the government phases out support to sooth the country’s cost-of-living crisis.

Some measures will stay around. The government announced this month that it will keep a value-added tax break on food in place until June. It also said transport will continue to be free of charge for certain groups, such as young people.

While ECB officials including Vice President Luis de Guindos have said Europe’s economy is losing steam and that there are risks of a recession, they’ve also indicated that price gains may pick up again in the short term.

That’s likely to keep interests rates where they are for some time, with policymakers also loathe to discuss when the first cuts may begin.

--With assistance from Ainhoa Goyeneche.