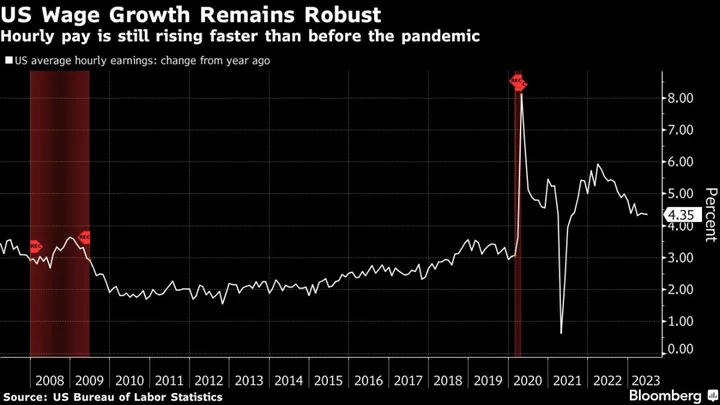

A monthly US jobs report due Friday is set to show wage growth continued to moderate in July, bolstering the case for an end to Federal Reserve tightening, according to Bloomberg Economics.

Average hourly earnings probably rose 0.3% last month amid “softer labor demand and somewhat higher supply,” marking a step down from June’s 0.4% increase, Bloomberg economists Stuart Paul and Anna Wong wrote Thursday in a preview of the report.

“Wage data show the pace of growth moderating, and the average hourly earnings data for July will likely add to evidence that the stickiest part of inflation is easing,” Paul and Wong said. The US central bank’s rate hike in July “likely was the final one before an extended pause.”

While weekly filings for unemployment insurance remain near pre-pandemic levels and wage growth is still above levels Fed officials view as consistent with their 2% inflation target, other indicators point to a shift away from the frenzied demand for labor that has characterized much of the last three years.

Job openings have in recent months fallen to the lowest level since 2021, and hours worked seem to have stalled. At the same time, prime-age participation, a measure many view as an indicator of labor supply, has risen above 2019 levels.

Here’s what Bloomberg Economics is expecting:

- US employers added 200,000 workers to payrolls in July, which would be the slowest increase since the end of 2020 but only slightly below June’s rate of hiring.

- The unemployment rate probably rose to 3.7% from 3.6%.

The Bloomberg Economics projections are mostly in line with consensus estimates in a Bloomberg survey of outside forecasters.

Read More: Bond Market on the Ropes Confronts Risk of Pivotal Jobs Report

The resilient job market has been the backbone of the the economy, which showed surprise strength last quarter after more than a year of interest-rate hikes.

With an employment rate at near-record lows and rising wages, Americans have kept consuming. Bank of America Corp. this week become the first large Wall Street bank to officially reverse its call for a recession amid growing optimism about the economic outlook, joining the Federal Reserve’s economic staff, wh0 are now no longer forecasting a recession.

Bloomberg Economics still expects the economy to slide into recession toward the end of the year, Paul and Wong wrote in their note.

Cracks in the labor market are already emerging, they said. Hours worked have stalled in recent months, and gains in labor-force participation partly reflect greater motivation to work as household finances deteriorate.