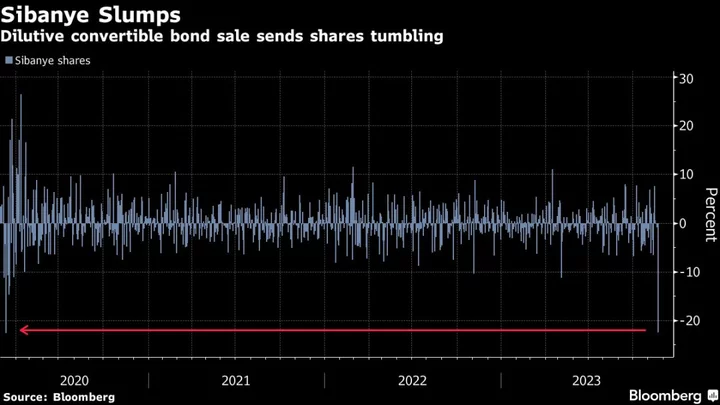

Sibanye Stillwater Ltd. plunged the most since March 2020 after the South African miner of platinum-group metals said it will raise $500 million by selling bonds convertible into its shares, a move that will dilute existing investors’ holdings.

The stock sank as much as 25% in Johannesburg, wiping out about 15.2 billion rand ($824 million) of its market value. The use of the bond proceeds includes funding the Nov. 9 purchase of US metals recycler Reldan Group of Companies for $155.4 million in cash, Sibanye said in a statement Tuesday.

Sibanye is deepening its push into producing platinum-group metals, used to curb pollution emitted by internal combustion engines, while contending with weakening commodity prices. Analysts at Citigroup Inc. said the bond deal heightens the “acquisition risk overhang.”

The risk is higher “especially in the current lower commodity price environment,” Citi analysts led by Ephrem Ravi wrote in a note. Sibanye trades at a discount to its peers, reflecting these concerns, according to the analysts.

Still, investors appeared attracted to the new debt. Indicated demand for the bond exceeded the deal size, according to terms sheets seen by Bloomberg News. Orders below the midpoint of the marketing range risk missing the transaction, according to the terms.

RBC Capital Markets analyst Marina Calero estimated that the conversion of bonds would generate a 14% dilution to shareholders. The bond issue should allow Sibanye to finance its acquisitions while preserving the balance sheet, however the dilution on existing shareholders would offset these benefits, she wrote in a note.

Sibanye shares were 19% lower by 4:34 p.m. local time, with the weakness spreading to its local peers. Impala Platinum Holdings Ltd. slipped 6.9%, Anglo American Platinum Ltd. was down 5.7% and Northam Platinum Holdings Ltd. lost 3.5%. The decline in Johannesburg’s precious-metals producers index was limited to 2.5% by gains in gold companies.

The conversion price is expected to be within a range of 30%-35% above the volume-weighted average price of Sibanye’s shares, between the opening and closing of trading in Johannesburg Tuesday, the company said. The senior, unsecured, guaranteed convertible bonds, due in November 2028 are expected to pay an annual coupon of 4%-4.5%.

--With assistance from James Cone and Rene Vollgraaff.

(Adds RBC comment, moves in shares of other platinum producers.)