Hello, from Washington. This week, the world’s two most powerful leaders are set to meet on the sidelines of the Asia-Pacific Economic Cooperation forum in San Francisco. President Joe Biden and China’s Xi Jinping will chat face-to-face for the first time in a year with geopolitical tensions heightened. The White House cited a resumption of US-China military communications as a priority ahead of this week’s meeting. Iran also is on the agenda. Biden is expected to raise the need for open lines of communication, including in the military realm, and discuss issues involving artificial intelligence, fentanyl and detained Americans in China, according to senior administration officials.

The big hang-out: Biden isn’t the only American who Xi Jinping plans to see this week. A group of his “old friends” from Iowa have been invited to a dinner he’ll attend on the sidelines of APEC—38 years after they welcomed the then-unknown party official for a hog roast, farm tours and a Mississippi River boat ride as they showed him how capitalists do agriculture.

The big cost: With Israel’s war against Hamas costing the economy around $260 million every day, payouts to ultra-orthodox schools and other causes championed by right-wingers in the ruling coalition have set off a reckoning for Prime Minister Benjamin Netanyahu. Israel on Sunday pressed on with its military offensive against Hamas in Gaza, engaging in ground battles in a northern refugee camp while rejecting rising international calls for a cease-fire. Read the latest here.The big relief: Changes to existing student loan programs have allowed for more than $127 billion in debt to be forgiven since Biden took office, according to new calculations. It’s welcome relief for millions of borrowers after the Supreme Court struck down Biden’s one-time forgiveness plan, estimated to cost $400 billion.

The big surprise: There’s still room for additions to the APEC guest list, it seems. Colombian President Gustavo Petro will join Pacific Rim leaders at the event. This visit will bring Petro together with his counterparts from the US and China, Colombia’s two largest commercial partners, accounting for around 40% of the nation’s foreign trade.

The big proposal: The looming threat of a government shutdown has eased, though not gone entirely. Newly elected House Speaker Mike Johnson delivered a stopgap plan that would extend funding for some government agencies to January and others to February. Democrats probably won’t love the two-step proposal, but the limited immediate spending cuts mean it’s more likely to pass the Senate.

The big swindle: Former crypto titan Sam Bankman-Fried’s downfall will hold a unique spot in history, compared with other heavily publicized fraud cases like Bernie Madoff’s Ponzi scheme or the crimes committed by Elizabeth Holmes at Theranos Inc. That’s because the rise and fall of FTX isn’t just a story about the misdeeds of one person. It’s a broader tale about the frenzy that erupted around a new type of financial system—one that’s designed to circumvent regulatory guardrails meant to protect investors from fraud and tragedy.

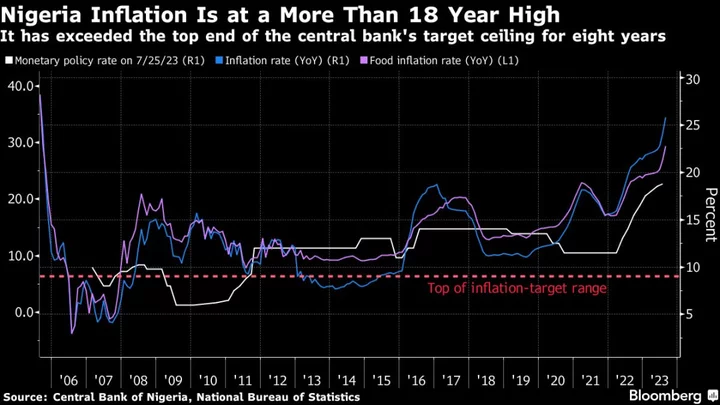

The big number: Federal Reserve officials are hesitant to signal an end to interest-rate hikes to quell inflation. Some of this can be attributed to the stubborn core consumer price index. The pace of inflation remains elevated and above the Fed’s goal, although significant progress has been made since hitting a multi-decade high a year ago, and Tuesday’s CPI report will give us more insight. While tightening has been paused at several consecutive meetings, policymakers are still proceeding deliberately — and not ruling out further increases. This week, look out for remarks from Chicago Fed President Austan Goolsbee and Fed Governor Philip Jefferson.

The big thought: As SAG-AFTRA actors put away their picket signs, there is a new problem that Hollywood fans must face, Bloomberg Opinion’s Paul Hardart writes. There will be less content and fewer jobs, a problem made worse by the value of the deal. According to a statement from the union, it’s $1 billion. And customers will ultimately be left footing the bill via those frequent subscription fee increases. But maybe it’s worth it to see all of our favorites on the screen again, Hardart writes. Enjoy the rest of your weekend.