By Medha Singh

U.S. retail traders rushed to lock in gains from a share rally sparked by signs of cooling inflation, looking to recoup losses in their portfolios from a brutal 2022 due to rising borrowing costs.

As bets of interest rates peaked and powered a 1.5% jump in the benchmark S&P 500 on Tuesday, Vanda Research said it sold individual stocks on a daily basis for the first time in three years.

Buying by such investors slipped to $201 million, their smallest amount since November last year, its data for the day showed, while J.P. Morgan said trading by retailers as a share of total market volume dropped to 14.8%.

Vanda analyst Lucas Mantle said the rally allowed them to book profits in some of their favorite tech names and better-performing large bank stocks.

Retail traders, who used to band together on online platforms to chase highly shorted shares during the days of easy money, have been seeing a reversal of fortunes as rising rates diminish their holdings in high-risk, high-return assets.

Despite recovering most of its losses since the start of the year, the average retail portfolio still remains at a loss of 14%, according Vanda Research. In January, such portfolios were down almost 40% on average.

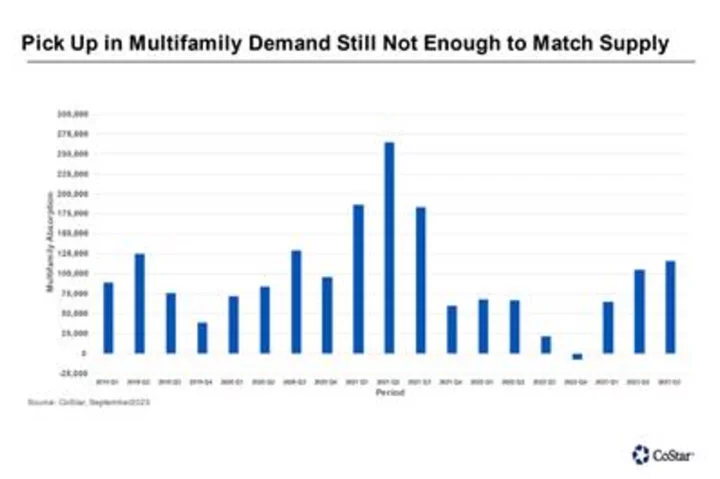

Retail investors have sold more than $55.31 billion in stocks over the past year, and just last month, they shed nearly $15.64 billion in stocks, the largest monthly outflow from the cohort since 2021, according to S&P Global Market Intelligence.

"Seasonality suggests that retail investors are unlikely to support any year-end rally, except for big-tech," Vanda's Mantle said.

Despite their overall slow buying, there were spurts of activity where retail traders chased sharp rallies in some small cap names - a typical trading strategy.

Solactive Roundhill Meme Stock index, which tracks some stocks with high short interest, has surged about 14% since the start of November, but remains down about 65.2% since its launch about two year ago.

"If we don't get any follow through it would be hard to say we've got retail traders back in the game," said Paul Nolte, senior wealth advisor and market strategist at Murphy & Sylvest Wealth Management.

Average retail investor

portfolio performance:

Month/yea 2021 2022 2023

r

January 4.1 -8.5 14.3

February -2.4 -2.6 0

March -0.5 5.2 5.7

April 4.3 -14.6 -2.7

May -2 -2.4 7.2

June 7.5 -10.5 9.8

July -1.1 14.3 4.6

August 3.3 -4.2 -3.7

September -3.9 -10.9 -6

October 10.8 4.6 -5.1

November 1.8 2.9 10.9

December -1.8 -11.8

Source: Vanda Research

(Reporting by Medha Singh in Bengaluru; Editing by Arun Koyyur)