The Reserve Bank of India left its key interest rate unchanged for a second straight meeting, signaling rate-setters want to see inflation moderate more after a tightening campaign while preserving the growth momentum.

A six-member monetary policy committee voted unanimously to keep the benchmark repurchase rate at 6.50%. All 40 economists in a Bloomberg survey predicted the hold.

The panel decided 5:1 to retain the policy stance focused on “withdrawal of accommodation,” which was introduced April last year. Thirteen of the 18 economists who shared their forecast on the stance expected the move.

“The repo rate is still working out in the system, the fuller impact will be evident in the coming months,” Governor Shaktikanta Das said in a livestreamed address from Mumbai on Thursday. “It will take further monetary policy action as required to keep prices firmly anchored.”

Indian equities headed for fresh all-time closing highs as foreign funds piled into the market and supported an extended pause on interest rates. Bonds edged lower, with the yield on 10-year security rising by two basis points to 7%, while the rupee was steady.

India joins most global central banks on pausing on rate hikes as commodity prices ease and policy makers are starting to signal their tightening cycle has concluded. At the same time, surprise rate hikes in Australia and Canada this week underscore the stickiness of inflation worldwide. The Federal Reserve may pause its aggressive tightening cycle when it meets next week while Bank Indonesia kept its benchmark rate unchanged for a fourth meeting.

“There is very little sense of any shift in RBI’s policy thinking today, as the resilient growth and falling inflation provides a lot of degrees of freedom, from a policy perspective,” said Rahul Bajoria, economist at Barclays Plc.

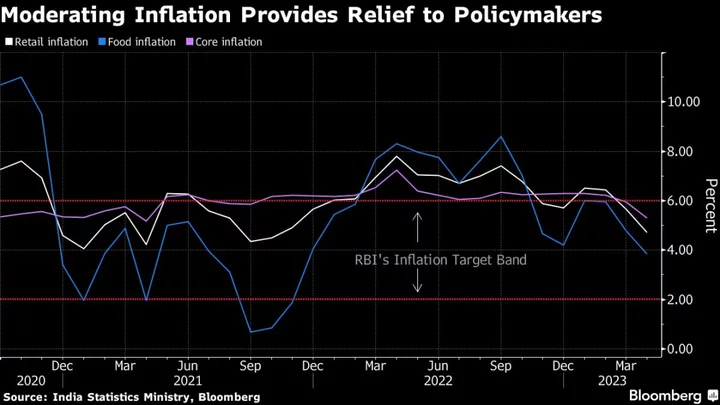

Economists surveyed in a Bloomberg survey saw India’s May’s inflation pace slowing 4.39%, a 20-month low when data is released next week. The RBI wants to see inflation settle near the mid-point of its 2%-6% range. Inflation in March and April fell within the upper limit of the target.

“Headline inflation still remains away from target, and staying just within the target range is not enough,” Das said, while trimming the RBI’s inflation forecast to 5.1% from 5.2%.

While this could give comfort to the Indian central bank, the rate-setters will train their focus on the progress of monsoons and the likely occurrence of El Nino this year, which dries up crops and tightens food supplies. The weather office has maintained its forecast for normal rainfall though the arrival has been delayed.

What Bloomberg Economics Says

The Reserve Bank of India moved in line with expectations in holding rates, but delivered a surprise by retaining a tightening bias. Keeping the stance of accommodation withdrawal signals the RBI now sees greater upside risks to the inflation outlook.

— Abhishek Gupta, India economist

For full report, click here

“The vigilance on inflation has been reiterated, indicating that the MPC is not ready to lower its guard on prices despite recent positive surprises, said Anubhuti Sahay, the Mumbai-based South Asia chief economist at Standard Chartered Plc.

The central bank retained a 6.5% growth target in the current fiscal year, indicating it wants to preserve the trajectory of India’s booming economy even as rising inequality is squeezing consumer spending. The latest quarterly growth figures blew past estimates, bringing India’s economic expansion to 7.2% and making the South Asian country one of the fastest growing regions in the world.

(Updates throughout)