Australia’s central bank Governor Michele Bullock pointed to a series of obstacles to bringing inflation back to target that range from sticky services prices to repeated global shocks including the Israel-Hamas war.

“There are a few things that are suggestive that it’s going to be difficult to get inflation down,” the Reserve Bank chief said during a fireside chat in Sydney on Wednesday, pointing to price pressures in everything from takeaway shops to hairdressers, as well as ultra-low unemployment.

Then there are supply shocks from global events that policymakers tend to look through, but are struggling to do so this time. “The problem is that we’ve got shock after shock after shock and the more that keeps inflation elevated, even if it’s a supply shock, the more people adjust their thinking, the more entrenched inflation is likely to become, so that’s the challenge.”

Bullock, in her first public appearance since taking the helm at the central bank, didn’t specifically address the outlook for monetary policy.

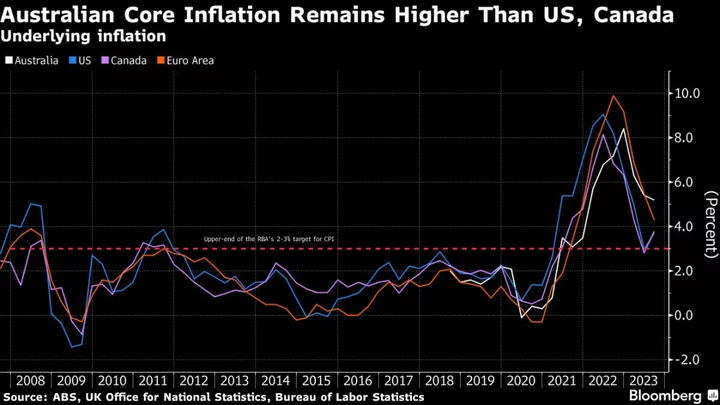

The central bank has increased interest rates by 4 percentage points since May 2022 in a bid to gain control over inflation that remains well above the 2-3% target. Economists expect one final hike, as early as next month, to take the cash rate to 4.35%.

All eyes are on monthly employment data released on Thursday and the third-quarter inflation report next week for indications of what the RBA will do. The central bank also receive its staff’s quarterly update of economic forecasts at the Nov. 7 policy meeting.

“It’s a challenging economic environment,” Bullock said. “What we are observing is that monetary policy is starting to bite. We are seeing a slowdown in consumption.”

Australia’s benchmark policy rate is lower than many other developed nations despite inflation being at least as high. The RBA’s 4 points of hikes in the current tightening campaign trail both the US and New Zealand’s 5.25 points.

“We are trying to bring inflation back down in a reasonable amount of time while preserving employment gains and not really bringing the economy to its knees,” Bullock said.

Data on Australia’s A$2.3 trillion ($1.5 trillion) economy has been mixed. Businesses are coping better with higher borrowing costs than households, with consumer sentiment in “deeply pessimistic” territory.

The labor market has proved resilient with the unemployment rate hovering between 3.4%-3.7% over the past year, near its lowest level since the 1970s. The residential property market has also unexpectedly rebounded strongly this year.

The housing market “has surprised me a bit,” Bullock said, noting it was now back at pandemic-era peaks.

(Updates with unemployment range over past year, extra comments.)