Australia’s central bank expects inflation will only return to the top of its 2-3% target by end-2025 and that a stronger economy will support employment, underscoring this week’s decision to resume raising interest rates.

The Reserve Bank sees headline inflation at 4% by mid-2024 versus 3.5% forecast three months earlier, and economic growth at 1.75% from 1.25% previously, according to its quarterly Statement on Monetary Policy released Friday. Unemployment is predicted to peak at 4.25% at end-2024 and then hold at that level through the following year.

“The domestic economy has proved more resilient than previously expected, and the labor market is expected to ease more gradually as a result,” the RBA said of its forecasts, which are based on a cash rate assumed to peak at around 4.5%. “The prospect of higher inflation over the year ahead increases the risk of embedding higher inflation expectations in price-setting decisions.”

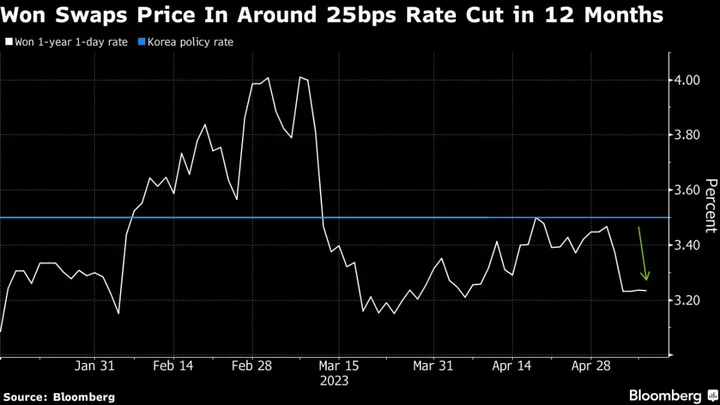

The central bank ended a four-meeting pause on Tuesday to hike the cash rate to a 12-year high of 4.35% in order to try to rein in prices.

The RBA’s restating of much of what it said in Tuesday’s rate statement saw Australian three-year government bonds rebound to pare declines. The yield on the notes was at 4.23%, up 7 basis points on the day, after trading at 4.25% before the statement.

Many economists including at Commonwealth Bank of Australia now predict the RBA has probably finished hiking, though National Australia Bank and Royal Bank of Canada are among a handful that see at least one more hike to 4.6%. Money market bets imply rates will remain above 4% over the next year.

“The board’s priority is to return inflation to target,” the RBA said. “Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks,” it said, reiterating Tuesday’s statement.

The RBA said it will continue to closely monitor the global economy, trends in domestic demand, and the outlook for inflation and the labor market in making its decisions.

“On face value, the new forecasts set leans hawkish given the size of the near-term revisions and indicates the RBA is further from its targets than previously thought,” said Tom Kennedy at JPMorgan Chase & Co.

“But upgrades were widely expected heading into the release, and the leadership had nevertheless chosen to slightly raise the bar for further tightening with this week’s guidance changes,” he said.

Inflation remains above 5% in year-ended terms, “well above” the target, the central bank noted. It said services-price strength is likely to persist for a while driven by labor market tightness and rising energy costs. Rent inflation is also set to remain high as surging population growth in recent quarters adds to demand in an already tight market.

Another factor adding to inflation is wage growth, which is seen peaking at 4% this year, from 4.1% forecast in August, and holding at that level in the first half of 2024 before easing thereafter. The RBA highlighted persistent poor productivity growth among upside risks to inflation. On the other hand, declines in global cost pressures and tepid inflation in China could bring down overall consumer prices.

Australia’s housing market has staged a surprising turnaround, rising for consecutive months since February amid the combined effects of high demand buoyed partly by strong population growth and limited supply. In addition, construction activity continues to be limited by capacity constraints because of labor shortages and a tightening of financial conditions.

The RBA highlighted household consumption as a “key source” of uncertainty, though a resilient labor market and higher house prices are likely to support sentiment. It added that spending in the economy has been supported by a rebound in international students and tourists.

--With assistance from Swati Pandey and Garfield Reynolds.

(Adds comment from economist in ninth-10th paragraphs.)