Bullish bets on high-yield corporate bonds are starting to unravel as interest rates look set to stay higher for longer.

Investors are turning back to safer investment-grade notes instead, saying the debt of junk-rated companies has gotten too expensive after a recent rally — especially as earnings are likely to deteriorate in an economic slowdown. Default rates are also expected to rise.

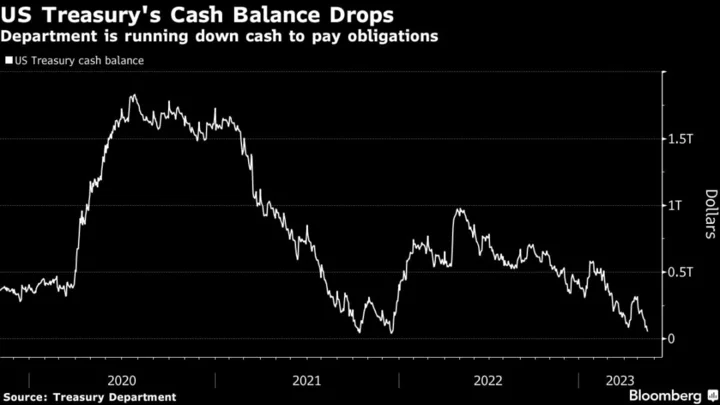

Oaktree Capital executives including chief investment officer Bruce Karsh wrote this week of companies facing a “cash crunch” amid slowing growth and rising costs. “We believe cash positions are more strained than today’s yield spreads might indicate,” they said.

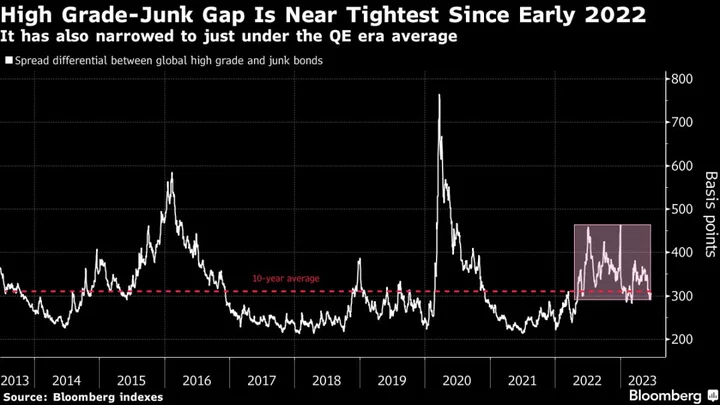

The gap between global investment grade and high yield spreads widened by 13.5 basis points this week — the first widening in six weeks — showing the start of a move to safety. At the same time, money managers in Bank of America’s latest survey now have the biggest overweight position in high-grade over junk debt since 2009.

It paints a picture of a sentiment shift for high yield bonds, which have been riding a rally in risk assets in recent months. They were, until recently, close to the most expensive compared with safer peers since early last year, in terms of the extra spread offered on riskier bonds.

The change is happening as markets get a wake-up call about the trajectory of rates. Federal Reserve Chairman Jerome Powell reiterated this week that the Fed is not done raising, while European Central Bank President Christine Lagarde has emphasized there’s still ground to cover. The Bank of England on Thursday unexpectedly hiked by 50 basis points.

Read More: US HY OPEN: Junk Bonds Snap Week-Long Rally on Powell Testimony

That’s making the yields offered in safer debt more compelling. The yield on an index of global high-grade bonds maturing within the next three years has risen so much that, at 5.4%, it pays as much as junk bonds did in early 2022.

Steven Oh, global head of credit and fixed income at PineBridge Investments, says the gap between BBB rated bonds in the US and BB rated notes should be at least 50 basis points wider than the current 100 basis point spread to adequately reflect risks. Ian Horn, a portfolio manager at Muzinich & Co., recommends steering clear of single-B rated junk bonds, some of which may struggle to refinance their debt as it comes due. He prefers BBB notes and good quality tier 2 bank debt.

A small portion of weaker companies also run the risk of failure as borrowing costs rise. Moody’s Investors Service expects global speculative-grade corporate defaults to peak at 5% by the end of April 2024.

Investment-grade yields now offer one of the best entry points for investors since the global financial crisis. That’s particularly important as Oh and Horn both see the regular income from holding bonds as the main driver of returns for the rest of the year, instead of betting on big price moves.

To be sure, those moving into high-grade run the risk of repeating the experience of the past two months. A change in tone from central banks later in the year could shift the picture again, while junk bonds are also less vulnerable to yield increases compared to longer-dated high-grade debt.

Still, the safety of investment grade is attractive right now. “The Fed might cut or it may not. You can take some of the highest yields in short-dated bonds, where there is no default,” said Horn. “It’s a comfortable place to be.”

Week in Review

- Mortgage-backed securities are “screaming cheap,” according to Bryan Whalen, co-chief investment officer and portfolio manager at TCW Group Inc.’s fixed-income group.

- High-yield companies lined up to fund at the fastest pace in five months after risk premia dropped to the lowest since credit markets were roiled by the regional banking crisis in March.

- Distressed companies are selling assets to relieve pressure from rising rates, slumping earnings and a looming maturity wall.

- Private equity firms are turning to direct lenders instead of banks and the broadly syndicated debt market to finance small acquisitions for companies already in their portfolios. That’s partly because private lenders can sidestep a most-favored-nation clause that pushes up funding costs.

- Returns for private credit funds are likely to diverge more significantly as company defaults tick up.

- T. Rowe Price Group Inc., Allspring Global Investments and AllianceBernstein Holding LP are among investors seeking opportunities in longer-dated high-grade corporate bonds.

- Commercial real estate firm Unibail-Rodamco-Westfield SE is offering its hybrid bondholders a debt swap ahead of an early redemption date later this year. Typically, companies call this type of debt at the first opportunity, but a jump in refinancing costs has made this prohibitively expensive for some.

- South Korea’s $169 billion sovereign wealth fund plans to allocate 25% of its assets in the category that includes private equity and credit, Chief Executive Officer Seoungho Jin said.

- Lombard Odier’s head of Asian fixed income — a rare bull on Chinese junk — has been scooping up dollar notes of troubled conglomerate Dalian Wanda Group Co. and logistics firm GLP China Holdings Ltd.

- The world’s most indebted developer, China Evergrande Group, expects to make an application late next month to courts regarding its multi-billion dollar offshore-debt restructuring plan. It’s also set to release audited financial results for the past two years.

On the Move

- Natixis SA tapped Asif Khan from MUFG Securities, where he was global head of collateralized loan obligations.

- John Aylward’s credit hedge fund Sona hired Barclays Plc’s co-head of global leveraged finance syndicate Stephen Smith.

- Former Credit Suisse Group AG banker Matthew Grinnell joined Sumitomo Mitsui Financial Group’s US arm to build out leveraged finance.

- Hilco Corporate Finance recruited Kyle Herman and Sanjay Marken for restructuring advisory in Houston.

- Schonfeld Strategic Advisors appointed former Macquarie trader Toby Kung as head of credit for Europe.

- Cantor Fitzgerald LP hired Ted Anibal and Arthur Tetyevsky from Seaport Global Securities for its hybrid/preferred team.

--With assistance from James Crombie, Catherine Bosley, Bruce Douglas and Dorothy Ma.