PineBridge Investments has turned bullish on China saying the authorities are starting to look more determined to bolster the ailing economy and there are fewer headwinds facing private companies.

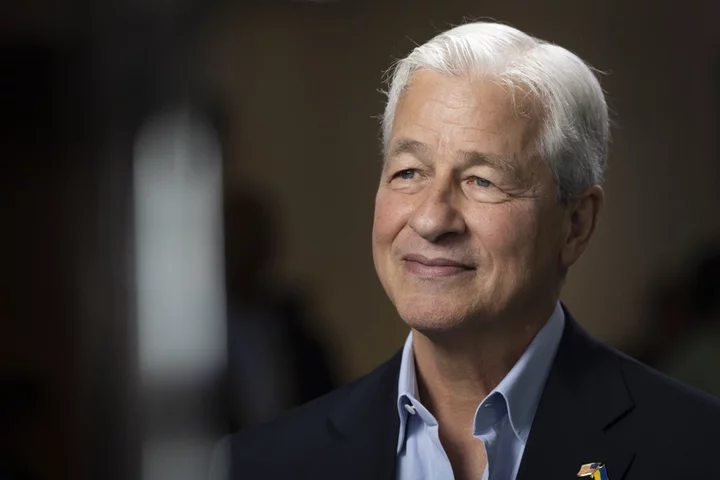

The money manager is particularly positive on the nation’s tech firms due to easing restrictions, which helped the sector lead favorable earnings surprises in the second quarter, said Michael Kelly, who manages about $18 billion as global head of multi-asset in New York.

“We’re one of the few people in the world with the stomach to say we like China,” Kelly said in an interview. “There are less policies that are depressing private-sector confidence than in the last five years. What’s different now is, since November, they’re actually becoming more pragmatic on economic issues.”

China stocks have been pummeled since early 2021 as the nation’s recovery from Covid has petered out and a rolling property crisis has derailed sentiment. The benchmark CSI 300 Index has tumbled about 36% from a high set in February 2021. Mainland markets are shut through the end of next week for holidays.

Economists have been downgrading forecasts for the nation’s growth for much of this year amid the real-estate woes, depressed consumer spending and shrinking exports. Still, there are some signs the economy is starting to stabilize with better-than-expected readings for factory output, retail sales and industrial profits this month.

Property Concerns

The nation’s property market remains a concern with President Xi Jinping and his government resistant to giving too much support to the sector, Kelly said.

“They don’t want to take any measures to relieve the downward pressure on construction of investment properties — it’ll be the last thing he comes to the rescue with,” he said. “But meanwhile, they have put in place a mechanism to finance some urban renewal properties.”

Another challenge facing the authorities is how to manage the yuan.

While China has deployed a number of policies to support flagging growth, it’s been reluctant to let the currency weaken as that may detract from Xi’s aim of making it a possible alternative to the dollar, Kelly said.

“If you want people to use your currency, you can’t expect them to do so when it’s overvalued and your economy is weakening,” he said. Managing the currency “toward slight undervaluation will see easier yuan adoption while strengthening their economy.”

Global South

The yuan has declined 5.5% versus the dollar this year, but that’s less than the drop in the currencies of some of its main trading rivals: South Korea’s won has fallen 6.2% and the yen has tumbled more than 12%.

China’s aim of increasing the use of the yuan among nations in the so-called Global South — a term used to refer to less developed nations — will take 10 or 20 years to succeed, if it happens at all, Kelly said.

“When they realize that, they’ll start using their monetary and liquidity conditions more vigorously,” he said. “So there will be an easing along the way — we think it’ll happen before year-end.”

(Updates to add holiday details in fourth paragraph.)