Just a couple of months ago, emerging-market assets were all the rage as inflation eased and interest rate-cut bets surfaced. The trade has all but fizzled out.

The rapid change has come about as oil rallied some 30% from the year’s low to alter the dynamics for developing nations. Costlier crude is reviving price pressures and damping hopes that interest rates will fall, while threatening to undermine the fiscal balances of energy importers.

It’s a shift that may upend the wagers of emerging-market bulls who had started the year on a high note. From Indian bonds to the Hungarian forint and the Philippine peso, developing-nation assets are looking increasingly vulnerable as the US vows to keep borrowing costs higher for longer and oil barrels toward the $100 mark.

“It is clear that the disinflation trend in EM ex-China has already faltered,” said Jon Harrison, managing director for emerging-market macro strategy at GlobalData TS Lombard in London. “Oil prices are certainly a material part of that, but food prices, a stronger dollar and less disinflation from China are additional drivers.”

The cracks are starting to show. A Bloomberg gauge of emerging-market government bonds and an MSCI index of developing-nation currencies are both closing in on a second month of declines.

Economies which are dependent on oil imports and those where crude accounts for a high percentage of household income will be the worst off, Tellimer strategist Hasnain Malik wrote in a note. These include India, the Philippines, Pakistan, Jordan, Kenya and Morocco.

Vontobel Asset Management is looking to trim its position in markets that are highly dependent on oil imports as the higher cost will hit the countries’ balance of payments and currencies, said Carlos de Sousa, an emerging-market money manager.

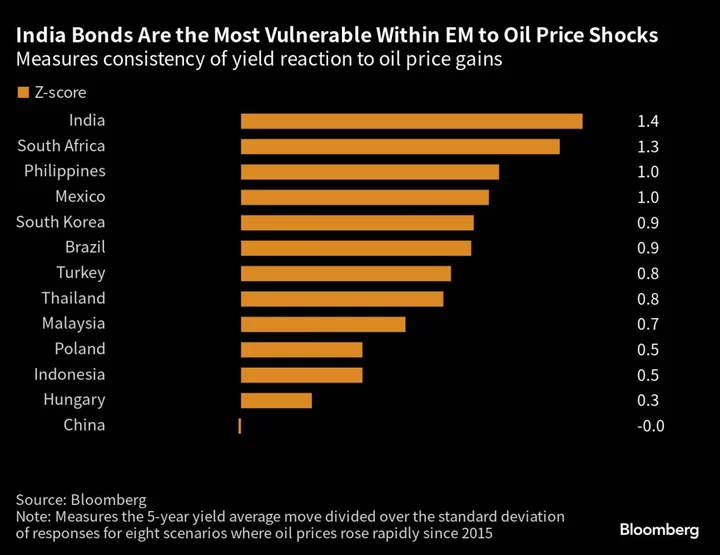

India’s bonds are the most susceptible to a surge in oil prices, according to Bloomberg’s analysis of five-year government securities from 13 major emerging economies. Rupee notes have displayed the most consistent reaction to a spike in crude, with their yields climbing an average of 13 basis points on eight occasions since 2015, as measured by the mean move divided over the standard deviation of responses.

Flatter Curves

Nomura Holdings Inc.’s economists including Sonal Varma say that unlike the previous episodes, the rise in oil prices is unlikely to translate into higher retail prices in India due to the upcoming state and general elections. “This means a limited inflationary impact, but a bigger spillover on the twin deficits.”

HSBC Holdings Plc notes that South Africa’s bonds may also suffer given the nation’s status as a net oil importer. At the other end of the spectrum, GlobalData TS Lombard reckons Chinese debt will be the most resilient as high oil prices help normalize producer price disinflation.

For economies which are negatively impacted by oil prices, the easing cycle would likely be postponed or slow down, according to Esther Law, senior money manager for emerging-market debt at Amundi SA in London. “In this scenario we could see the local curve flattening with cuts being priced out.”

The impact of the spike in oil prices is not uniform. For energy exporters such as Malaysia, Mexico and Saudi Arabia, costlier crude is a positive as it may help to boost government revenues.

FX Pressure

On the foreign-exchange front, pricier crude and the stronger dollar are negative for the Philippine peso, Indonesian rupiah, Thai baht and the forint, according to Gaël Fichan, senior portfolio manager at Banque Syz SA.

“Higher oil prices will likely act as a tax on other economies which are net importers, reducing real incomes and slowing growth,” said Marcella Chow, global market strategist at JPMorgan Asset Management. “This could put downward pressure on their currencies and their central banks may need to maintain interest rates at the current level, or even raise rates, to protect their currencies.”

It’s already happening in the Philippines, where the central bank sees a “good chance” that it’ll resume monetary tightening in November and may increase rates further after that to counter supply shocks.

The following table shows the impact of previous oil-price increases on emerging-market bonds:

- NOTE: Data are based on eight events: a strike at U.S. refineries in 2015, hurricane impact on oil supplies in 2017, OPEC oil curtailment in 2017, the U.S.-Russia proxy-conflict in Syria in 2018, attack on Saudi oil facilities in 2019, OPEC curtailment in 2021, Russia’s war on Ukraine in 2022 and OPEC+ tightening of supplies in 2023

What to Watch

- Bank of Thailand will announce its rate decision on Wednesday, after the governor warned the nation’s new government against fiscal recklessness

- China will release September private and official survey results of manufacturing and non-manufacturing activity amid continued concerns over the outlook for the world’s largest EM economy

- Hungary and the Czech policy makers will announce rate decisions, following a surprise 75-basis point rate cut by the Polish central bank earlier this month. Poland will release preliminary September inflation figures too

- Mexico and Colombia will announce rate decisions, with investors watching for any dovish signs following recent easing moves by Brazil and Chile

--With assistance from Netty Ismail, Robert Brand and Matthew Burgess.

Author: Marcus Wong, Malavika Kaur Makol and Tassia Sipahutar