Oil steadied after a two-day advance as traders count down to a key meeting that will see OPEC+ set output policy into the new year.

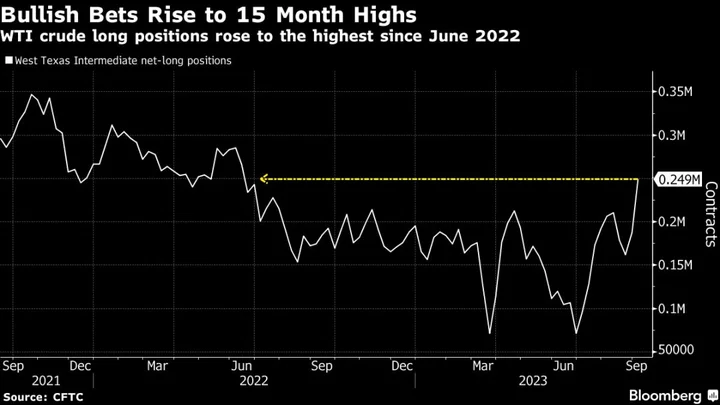

Global benchmark Brent traded under $83 a barrel after rising almost 4% over the prior two sessions, with West Texas Intermediate below $78. OPEC+ heavyweight Saudi Arabia is pressing fellow members to join it in restraining output to stave off a renewed oil surplus next year, but is facing pushback from nations including Angola and Nigeria before a virtual meeting later Thursday.

A deeper collective cutback of 1 million barrels a day or more may be considered, delegates said. The absence of group-wide reductions may spur more weakness in oil prices — after Brent dropped roughly 13% over the past two months — amid plentiful supplies from outside the producer group, including record exports from the US.

“There are growing expectations that they could make deeper supply cuts,” said Warren Patterson, head of commodities strategy at ING Groep NV. “This growing expectation leaves downside risk for the market if OPEC+ disappoints later today.”

JPMorgan Chase & Co. and Eurasia Group were among the latest to flag looser supply-demand balances, after the International Energy Agency said earlier this month the market would flip back into a surplus next year.

RBC Capital Markets LLC expects OPEC+ will likely reach an agreement with holdouts Angola and Nigeria that will allow the broader group to commence discussions on output, analysts including Helima Croft said in a note. If the issues can be settled, then there’s “significant scope” for the group to do a collective deeper cut, they said.

In the US, crude stockpiles rose for a sixth week to the highest levels since July, Energy Information Administration data showed. Levels at Cushing also gained, while exports of crude and products rose to a record of almost 4.5 million barrels a day last week, it said. The American Petroleum Institute had earlier forecast a drop in nationwide inventories.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.