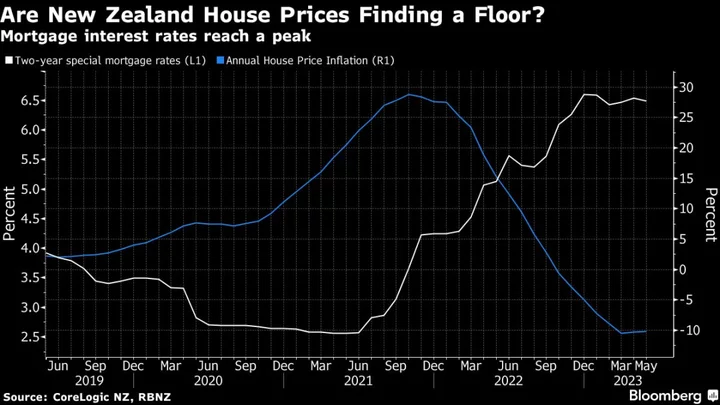

New Zealand house prices fell by the most in eight months in June, showing the market has yet to find a floor even as interest rates reach their peak.

Values fell 1.2% from May and have now declined for 15 straight months, CoreLogic New Zealand said Wednesday in Wellington. That’s the biggest fall since a 1.3% dip in October. From a year earlier, prices dropped 10.6% compared with 10.2% through May.

Rising home-loan interest rates and a slowing economy have pushed buyers to the sidelines, driving property prices sharply lower over the past year and a half. The Reserve Bank’s decision in May to signal no further increases in the Official Cash Rate stoked optimism the housing market would start to improve in the second half of 2023.

“What the data is telling us is that housing market conditions remain diverse,” said CoreLogic NZ Head of Research Nick Goodall. “While some markets may be moving through a trough in the cycle, others may have further to decline. We still believe it appears the worst of the downturn is generally over for most areas.”

Goodall said the overall volume of properties for sale is low. That tight supply coupled with high net immigration, looser credit requirements and signs that mortgage interest rates have peaked should support demand and allow prices to eventually climb, he said.

Despite the sustained fall in prices, average values are only back to mid-2021 levels and remain unaffordable for many, he said, suggesting there is unlikely to be a flood of demand or strong bounce in prices.

The average house price slid to NZ$911,222 ($560,000) in June, CoreLogic said. Prices in largest city Auckland fell 3% from May and are 12.5% lower than a year earlier.