Short seller Carson Block’s bet against a Czech billionaire’s property firm is set to round out a relatively quiet year of bearish wagers for Muddy Waters Capital LLC.

CPI Property SA bonds slumped to record lows on Tuesday after Block’s company said it was shorting the Eastern European landlord’s credit. The short seller claimed CPI, owned by Radovan Vitek, is overstating the value of its assets and its cash accounts could be misstated. CPI said it will respond to the claims in due course.

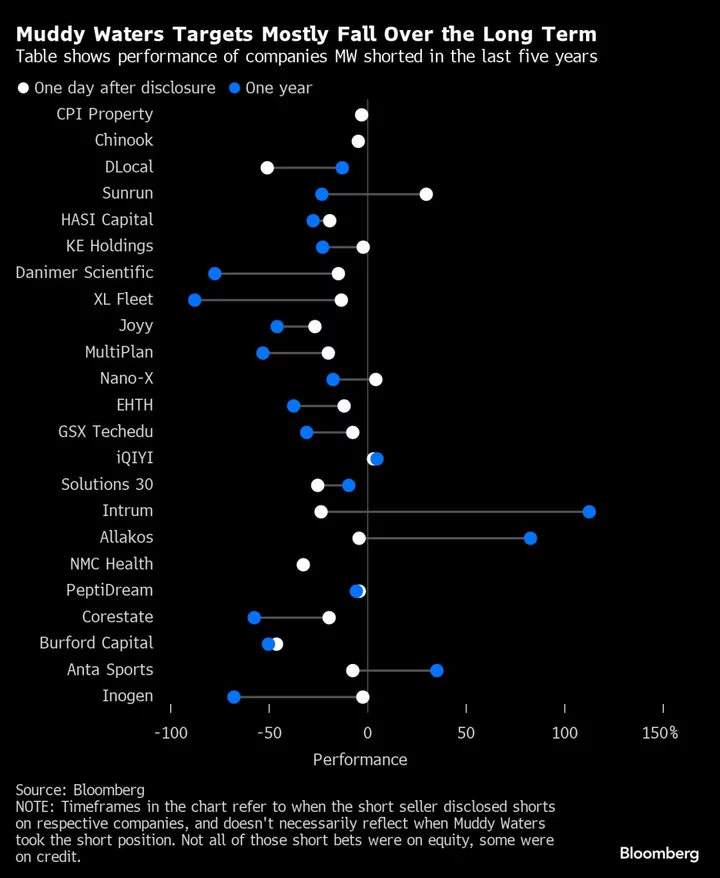

With just a few new positions disclosed this year, according to publicly available research on its website, a scorecard of the money manager’s bets in the past five years shows that the vast majority of its targets drop after the short position is unveiled. Shares on average lost about 13% in the first day, and were down 19% a year later, according to calculations by Bloomberg News. Some of its targets, such as French retailer Casino Guichard Perrachon SA, never recovered.

Dates in the above chart refer to when the short seller publicly disclosed the position on respective companies, according to data compiled by Bloomberg.

Activist shorting is a strategy that involves betting against a company and publishing research reports intended to convince the market that the target’s publicly-traded instruments are overvalued. While some accusations by short sellers have held up and prompted regulatory or legal action in recent years, others have proved unfounded and tainted by ulterior motives.

“The most interesting shorts to us are when we have robust fieldwork,” Block said in response to a request for comment from Bloomberg News.

Below are some of Block’s most notable bets and how they performed:

Sunrun (July 2022, October 2023)

Muddy Waters said it shorted Sunrun Inc. shares in October — Block’s second move on the solar-energy company after his first bearish take on the firm in July 2022, which saw the stock lose 23% in the subsequent year. In his most recent report, Block referred to the company as an “ESG hustle.” In response, Sunrun said the call was “deceptive” and “incorrect.”

NMC Health (December 2019)

Middle Eastern hospital operator NMC Health Plc proved a big win for Muddy Waters. Its December 2019 report alleging that NMC was understating its debt and overstating its cash triggered a financial scandal which swept through London and the United Arab Emirates.

While NMC Health denied wrongdoing, a subsequent probe of financial irregularities found evidence of suspected fraud after the company disclosed a hidden $2.7 billion debt pile. The stock has since been delisted in London.

Burford Capital (August 2019)

Litigation funder Burford Capital Ltd. saw its shares lose half their value within a year of Muddy Waters accusing the firm of overstating returns on its investments and using questionable financial reporting and governance.

The company fought back, but ultimately ended its efforts to investigate the crash in its share price after a London judge found its stock wasn’t the target of any “unlawful market manipulation.”

Anta Sports (July 2019)

Not all of Block’s bets have paid off. The research firm raised concerns over Anta Sports Products Ltd.’s financial reporting and relationship with distributors, allegations which the company denied.

Despite being the subject of multiple critical reports, the Hong Kong-listed company ended up rallying 35% in the ensuing 12 months as consumers embraced patriotic fashion amid a trade war with the US.

Solutions 30 (May 2019)

Muddy Waters first targeted the technology-services company, a favorite with short-sellers, in 2019. Its shares lost nearly a third of their value in the next six months.

Block persisted with his campaign and renewed criticism of the firm two years later. His initial bet was vindicated after Solutions 30’s auditor couldn’t sign off on its 2020 accounts, and Block closed his position. An independent auditor later concluded that allegations of criminal wrongdoing made in an anonymous report were unfounded.

Author: Jan-Patrick Barnert and Kit Rees