A look at the day ahead in U.S. and global markets by Harry Robertson

It's been a tough little patch for U.S. stocks, with the benchmark S&P 500 index falling for five of the last six sessions. It dropped 2.3% last week, its biggest weekly fall since the banking turmoil of March.

Things look a little brighter this morning, with U.S. stock futures up slightly and European equities rising in the morning session.

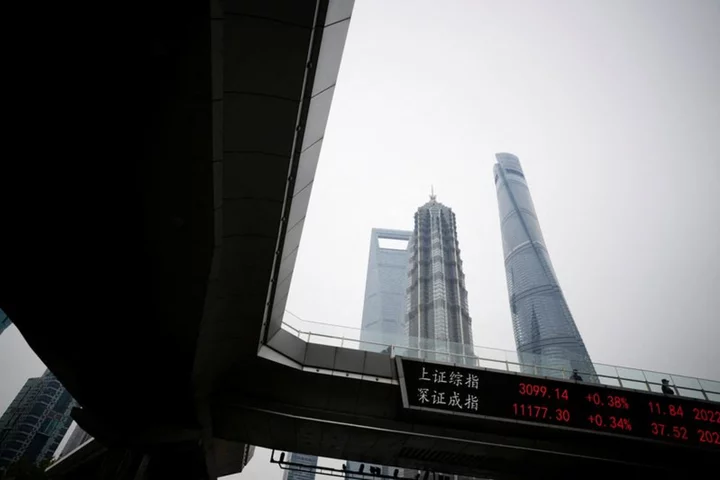

It seems there's only so much bad Chinese news traders can pay attention to. Data out today showed the economy fell into deflation in July, with prices dropping 0.3% year-on-year.

On Tuesday, figures showed Chinese imports dropped 12.4% in July year-on-year, while exports contracted 14.5%.

"It's been probably three or four months since we've started to realise actually China's reopening is not this panacea for global growth that we might have hoped for," says Timothy Graf, head of macro strategy for EMEA at State Street.

Italy's decision to water down the bank tax which shook markets on Tuesday has helped restore some confidence, particularly in Europe.

The dollar index was giving back some of its recent gains, as investors moved out of safe-haven assets. Bond yields were little changed.

As of Wednesday, however, the greenback was on track for its fourth straight weekly increase - hardly a bullish sign for global markets.

Adding to the downbeat mood on Tuesday was a report by Moody's that cut the credit ratings of several small to mid-sized U.S. banks.

The next big test is U.S. inflation data for July, due on Thursday. It's expected to show a pick-up in price growth to 3.3% year-on-year, from 3% in June. Core inflation is expected to hold steady at 4.8%.

It'll be a key input into the Federal Reserve's rate decision in September. Markets currently think rates are likely to stay at 5.25% to 5.5%, but they reckon there's a slim chance of another hike.

Another key question for U.S. markets, says State Street's Graf, is whether investors can keep the faith in the tech giants that have powered this year's 17% rally in the S&P 500.

"What does finally dent this? And is it just something stupid like seasonal (factors)? Well, unusually, that's kind of what's playing out," he says.

"From July 31 into now, you started to see some weakness in global equities and tech is going to be a huge part of that."

Key developments that should provide more direction to U.S. markets later on Wednesday:

* Walt Disney Company reports earnings

* MBA Mortgage Applications survey data

(Reporting by Harry Robertson; Editing by David Evans)