A look at the day ahead in European and global markets from Brigid Riley

Is the most aggressive U.S. hiking cycle in a generation finished? After Wednesday's 25 basis point hike, markets seem to think so.

Traders in Asia cheered a glimpse of the fabled soft landing with Jerome Powell saying the Fed no longer expects a U.S. recession. Stocks rose and the dollar fell across the board. The spotlight now falls on Christine Lagarde and the European Central Bank, which is all but certain to follow with an additional quarter of a percentage point hike later today.

The focus will be on President Lagarde’s tone and language for a guide on what's to come - with the outlook likely to move the euro and set the dollar's direction.

Markets had expected hawkishness, but were set aflutter last week when council member Klass Knot cast doubt on the need for hikes beyond July.

The Bank of Japan is then up on Friday, with perhaps the most unpredictable central bank decision of the week. The yen hit the strong side of 140 to the dollar as nobody wants to be caught short if there's a surprise tweak to yield controls.

European futures rose 0.3% and U.S. futures also added 0.3%.

On the earnings front, Renault, TotalEnergies and L’Oreal report in France and Intel, Ford, MasterCard, and McDonald's in the United States.

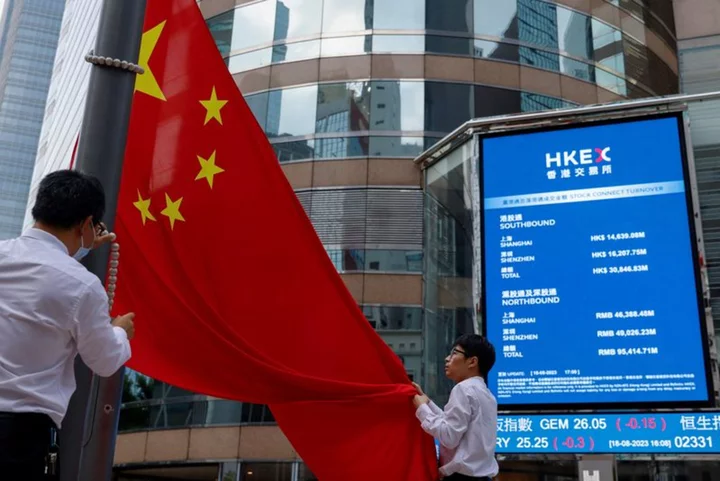

Stimulus hopes drove Chinese stocks higher on Thursday, with the Hang Seng Index up 1.4%, and its tech subindex gaining 3% and property stocks over 4%.

Key developments that could influence markets on Thursday: - ECB rate decision

- U.S. preliminary Q2 GDP numbers

- U.S. initial jobless claims

- U.S. June durable goods data

(Reporting by Brigid Riley; Editing by Muralikumar Anantharaman)