M&T Bank Corp. is the lone issuer tapping the investment grade primary market Thursday, as new issues trail market expectations this week, extending an October slump.

The bank is selling a $750 million fixed-to-floating rate note according to a person with knowledge of the matter. The six-year security that’s not callable for five years, will yield 2.6 percentage points above Treasuries, said the person, who asked not to be identified as the details are private. Initial talks had been for 2.8 percentage points.

Representatives for the bank did not provide a comment.

Weekly volume — even with the M&T deal — is poised to be one of the largest misses this year second only to the week of March 13 when Silicon Valley Bank’s failure spooked the banking sector. Activity slowed to $5.05 billion in new issue volume this week, well below the syndicate consensus average of $20 billion and the lowest end projection of $10 billion.

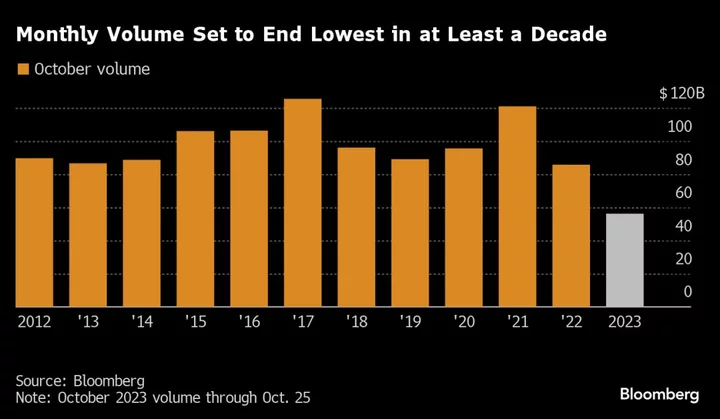

With yields hitting the highest since 2009, sending funding costs soaring and average risk premiums climbing, October is on track to have the lowest issuance volume in at least a decade, according to data compiled by Bloomberg.

“Market sentiment has been choppy and flows have not been great,” said Winnie Cisar, global head of strategy at CreditSights Inc. “I’m not surprised to see a bit of a hesitation from issuers, especially ahead of the Treasury refunding announcement and Fed meeting next week.”

M&T held investor outreach at the end of last week for the deal, but had stood on the sidelines until now. Truist Financial Corp. sold debt Wednesday, the first lender to test investor appetite even as banks were expected to continue the deluge seen last week.

Read more: Banks Put Bond-Sale Spree on Pause as Market Volatility Ramps Up

As more and more corporates report earnings, it’s expected they’ll carry the bulk of issuance next week. It’s likely they will have to be more cautious and find windows to issue new debt as volatility remains in the market. And with a Federal Reserve rate decision meeting on Nov. 1, it’s likely issuance will remain subdued, according to Cisar.

--With assistance from Michael Gambale.

(Updates to add pricing information starting in second paragraph.)