Robyn Grew, the newly appointed chief executive officer of the world’s largest publicly listed hedge fund, has a guiding mantra to help sustain the firm’s industry-defying growth: If it ain’t broke, don’t fix it.

Man Group Plc “has a cracking core business and my number one job, apart from anything, is not to break that because that is value and it’s real and it will continue to grow,” Grew said on Barry Ritholtz’s Masters in Business podcast. It was her first interview since the announcement of her promotion last week.

The first female to be named CEO of the 240-year-old firm spoke about her rise from a barrister to one of the top jobs in the fiercely competitive world of hedge funds. She discussed her vision for Man Group, rising demand for products that address environmental, social and governance concerns as well as the rapidly shifting world of technology with the advent of artificial intelligence.

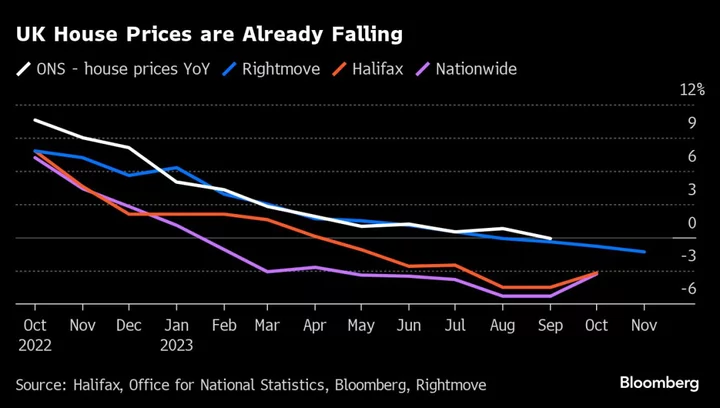

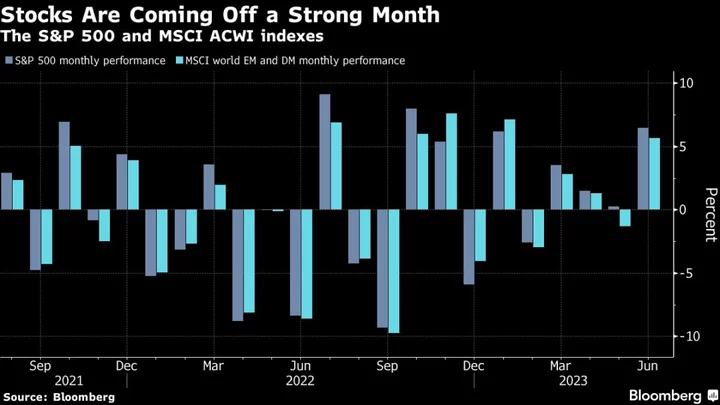

Grew, 54, will succeed Luke Ellis at a challenging time when the vast majority of industry players are struggling to retain investors amid market volatility, rising interest rates, a banking turmoil and simmering geopolitical tensions. For the sector’s watchers, her biggest test on the job will be whether she can match or beat the firm’s performance under Ellis.

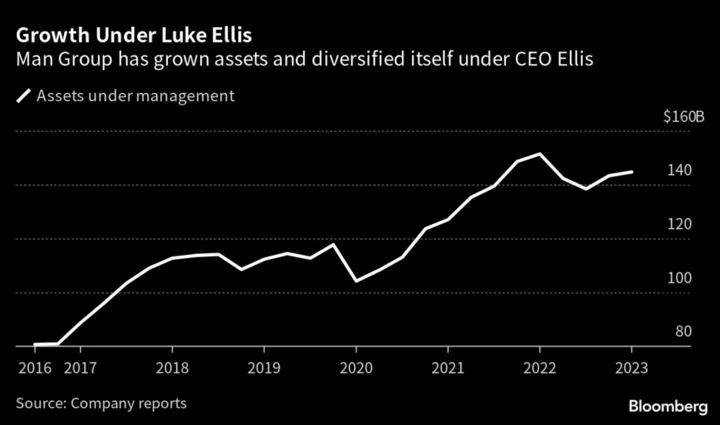

Assets under management at Man Group have grown to about $145 billion from the roughly $81 billion when Ellis took over in 2016. The share price, including dividends, of the London-based company has surged 163% on his watch.

Grew takes over her new role on Sept. 1 and will be joined at the top by Anne Wade, who’s set to become Man Group’s first woman chair, succeeding John Cryan toward the end of 2023.

In her comments on the podcast, Grew said the firm will continue to invest in its AHL and Numeric quant trading business units. It will also focus on bolstering its presence in the US, while exploring ways to grow through acquisitions to expand the range of strategies and offerings to clients, she added.

She called the generative AI behind the popular chatbot ChatGPT as the greatest disruptor over the last year and dismissed fears that the technology could be a threat to humans and jobs.

“If you think about it negatively, you’re missing the mark,” Grew said. “This sort of semi-hysterical fear of it is all wrong. There are undoubtedly gonna be benefits.”

As someone who has identified herself as a proud member of the LGBTQ community, she also spoke on the challenges that come with being “different.”

“The prejudice for me just kind of made me more punchy and made me more determined to succeed,” she said. “It makes me better at understanding what it feels like when you don’t belong.”

Rum Supplier

Man Group was founded in 1783 by James Man as a barrel maker-cum-brokerage on Harp Lane, about 500 meters from its current office along the Thames in London. Over the next two centuries, it supplied rum to the Royal Navy and traded commodities such as coffee and sugar before eventually focusing exclusively on financial services. In 1989, Man began acquiring a computer-driven trading shop called AHL, which, alongside Numeric, now houses all the company’s most cutting-edge AI work.

While the firm has diversified its business to a raft of strategies from hedge funds, long-only money pools to investments in private markets, the firm is still best known for its use of algorithms to make money. It’s one of the early adopters of AI tech and uses it to process data, power its quant models, portfolio construction, ESG prediction metrics and sentiment analysis of corporate earnings and annual reports.

“If we didn’t keep changing, we’d still be making barrels on the side of the River Thames and trading sugar and hoping that the Royal Navy still needed a lot of rum,” Grew said. “So that’s not where we are today, but the roots are deep.”

(Updates with Numeric unit in third-to-last paragraph.)