Malaysia will likely keep its benchmark interest rate unchanged on Thursday, as nine months of easing inflation coupled with the central bank’s recent ringgit intervention provide some reprieve for the new governor.

Bank Negara Malaysia will maintain the Overnight Policy Rate at 3%, according to all but one of the 18 analysts in a Bloomberg survey. Goldman Sachs Group Inc. expects the central bank to hike by a quarter point for a second straight time.

The July monetary policy meeting will be Shaik Abdul Rasheed Abdul Ghaffour’s first as BNM governor, a role he’s taken on less than a week ago. He looks to be under no immediate pressure to raise borrowing costs.

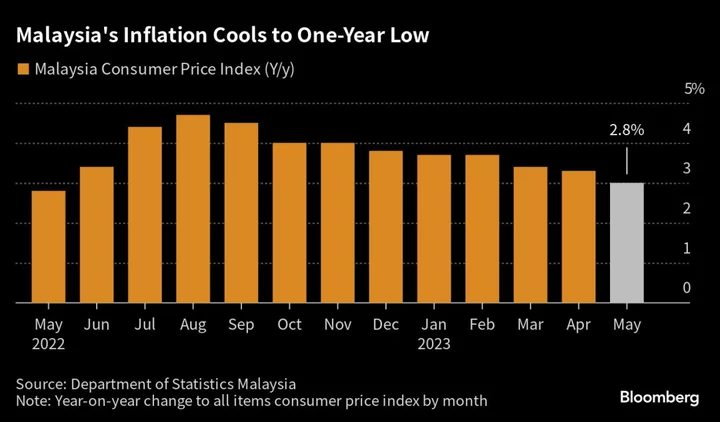

Concerns of financial imbalances are waning as Malaysia’s inflation rate moderated to a one-year-low on the back of a surprise interest-rate hike early May. Going forward, the government’s decision to maintain electricity tariffs for domestic users for the second half of 2023 “eases a major upside risk” to price pressures, according to analysts at CGS-CIMB. They lowered their inflation forecast to 2.8% from 3.3% due to the move.

There is also reduced urgency to bolster the ringgit using the rate tool. The central bank’s recent intervention in the foreign exchange market signals that “an interest rate defence of the currency” is not on BNM’s table for now, RHB Banking Group Chief Economist Sailesh K Jha said on Monday. The ringgit has gained 0.3% versus the dollar since BNM’s intervention announcement, though Sailesh cautioned that the move is unlikely to have a sustained durable impact.

There is political resistance toward a rate hike as well. Raising borrowing costs at this juncture could dent Prime Minister Anwar Ibrahim’s popularity ahead of the Aug. 12 local polls. Malaysia’s household debt is one of the highest in the region, with nearly 1.4 trillion ringgit worth of debt shouldered by citizens, according to the central bank.

The issue is so politically fraught that the communications minister in March accused a local media outlet of defamation after it said the OPR was expected to increase by July. To be sure, Anwar has maintained BNM has sole discretion in determining the interest rate, and the central bank did indeed raise borrowing costs in May.

There may still be a case for a rate hike Thursday. Leaving borrowing costs unchanged could see the ringgit hitting 4.75 against the dollar — a level not seen in years, according to brokerarge firm OctaFX, which expects BNM to hike by 25 basis points. “The renewed hawkish rhetoric from the US Federal Reserve further sets the stage for the weakening of the ringgit,” it said in a note Tuesday.

The ringgit remains the second-worst performing currency in Asia year-to-date, with Anwar last month attributing its fall to Malaysia’s low borrowing costs and the strengthening dollar.

What Bloomberg Economics Says...

The Fed has yet to stop hiking, and the ringgit — backed by softer oil prices and a less favorable real yield — has continued to slide. This means another BNM hike can’t be fully ruled out.

- Tamara Mast Henderson, Bloomberg Intelligence

Click here to read full note.

Steady domestic demand and sticky core inflation may lead BNM to consider another quarter-point-increase in the second half of 2023, said analysts at MIDF research. Core inflation rate continued to linger above 3.5% in May, versus the pre-pandemic average of 1.7%, they said.

--With assistance from Tomoko Sato.