Big box retailer Canadian Tire Corp. will cut 3% of staff and eliminate most vacant roles as consumers tighten spending on non-essential goods, especially in regions where housing costs are highest.

Comparable sales slipped 1.6% in the third quarter, the Toronto-based company said Thursday. Spending was particularly soft in British Columbia and Ontario, the company said, two provinces where homes are most expensive, as residents put more of their take-home pay into rents or mortgages after interest rates rose.

Canadian Tire said it expects to save about C$50 million ($36.3 million) on an annual basis by letting go of hundreds of employees. Its shares were down as much as 2.5% in early afternoon trading in Toronto.

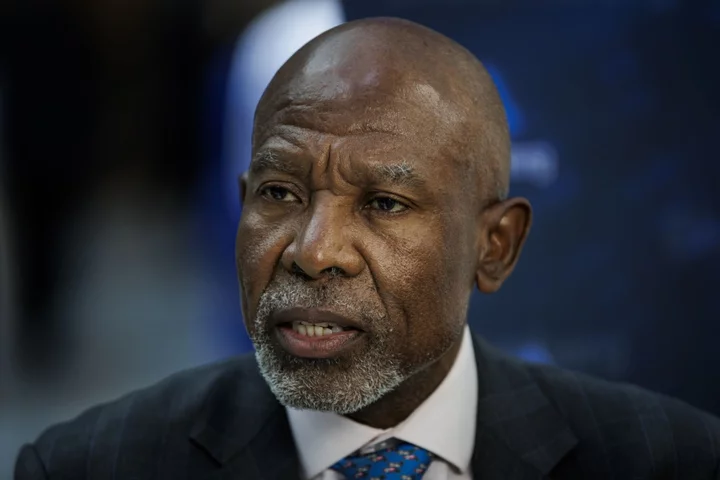

Chief Executive Officer Greg Hicks pointed directly at the Bank of Canada’s rate hikes for the economic challenges during a conference call with analysts. The central bank raised its policy rate to a 22-year high of 5% in the summer, though it held it there in September and October as it sees more evidence of a slowing economy.

“Suffice it to say, the future is increasingly murky given the Bank of Canada’s pause was couched in a hawkish tone around risks of further inflation and the potential of more policy rate moves down the road,” Hicks said.

“The amount of time the central bank will need to be in a holding pattern before decreasing rates will be a key determinant of the impact on consumer spending and the economy.”

What Bloomberg Intelligence Says

“Though Canadian Tire’s 3Q sales did decline, the drop was less than anticipated, giving reassurance the company is managing a difficult economic backdrop effectively. We reiterate our view that yearly sales could decline 1-3% on softer demand, adequate dealer inventory levels and difficult comparisons. We still expect higher demand for essentials, less traffic and fewer items in the basket to remain trends for the rest of the year.”

— Bloomberg Intelligence analyst Diana Rosero-Pena

The company earned C$2.96 per share on a normalized basis in the third quarter, falling well short of the C$3.28 analysts were expecting.

Canadian Tire’s main business is its namesake chain of stores that sell hardware, auto parts, housewares and other goods. Some of those locations also offer vehicle maintenance. The company also owns SportChek, a sporting-goods and apparel chain, and other smaller retailers that offer work clothing and party supplies in Canada.

(Updates share move in third paragraph, adds Bloomberg Intelligence commentary in seventh paragraph.)