A top-performing European fund manager is calling time on “hype” around weight-loss drugs that has sent Novo Nordisk A/S’s stock price rallying more than 50% this year.

Niall Gallagher, who runs an equity fund for GAM Investments that has returned 14% this year, said he had reduced a position in the Danish drugmaker by about half in the past few months, partly to reflect the surge in stock valuations as sales of its appetite-suppressing medications — known as GLP-1s — skyrocketed.

“We’ve been bullish on them for quite a while, but now there’s a lot of hype and it goes beyond just stock markets — you can’t open a Sunday newspaper without reading about the wonder drugs,” Gallagher said in an interview in London.

While he doesn’t see any competitors emerging to Novo and Eli Lilly & Co. — which makes the weight-loss drug Mounjaro — “for quite some time,” pharma drugs “don’t have perpetual patents, and at some point the patent runs out,” he said.

The frenzy around Novo’s Wegovy and a related medicine for diabetes called Ozempic has turned the firm into Europe’s most valuable company. The drugs have been endorsed by celebrities and entrepreneurs including Elon Musk, and the company has raised its full-year outlook for revenue three times.

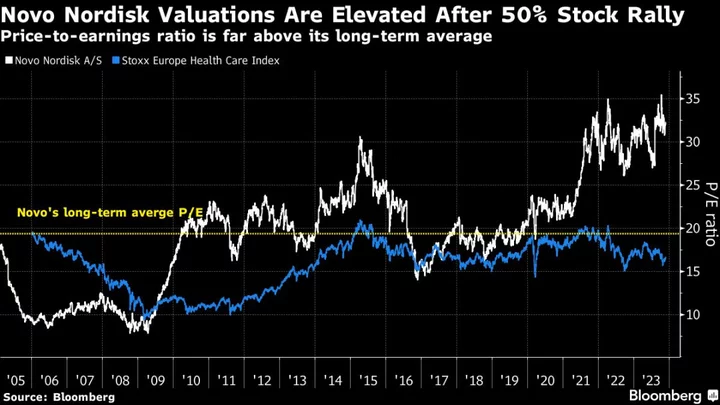

Novo shares trade at nearly 33 times 12-month forward earnings, well above its long-term average of 19. The price-to-earnings ratio of the broader Stoxx 600 Health Care Index is also much lower at about 17. Its share price is just half a percent away from the average target price of 31 analysts tracked by Bloomberg — suggesting little upside over the next year.

While the majority of the 32 analysts tracked by Bloomberg still have a buy rating for the stock, some have turned skeptical after the rally. UBS Group analyst Michael Leuchten said in September that the obesity revenue opportunity won’t be “as big as Novo’s current valuation implies.” A spokesperson for Novo declined to comment.

The €473 million ($518 million) GAM Star European Equity Fund that Gallagher runs has beaten 88% of peers this year, according to data compiled by Bloomberg. The fund’s top holdings in the latest filing at the end of October included Nestle SA, London Stock Exchange Group Plc and Linde Plc. Novo, which was the fund’s biggest holding at the end of July, is now the fifth-biggest. The fund first bought Novo shares in April 2020.

Gallagher said he remains optimistic about the company’s prospects over the medium-to-long term as he sees “good growth” amid strong demand and supply constraints.

“The risk-reward balance has changed and it’s less favorable, but not negative,” Gallagher said. “It’s just that where we are right now is probably as much as we want to pay in terms of the valuation multiple.”

--With assistance from Jonas Ekblom and Sanne Wass.