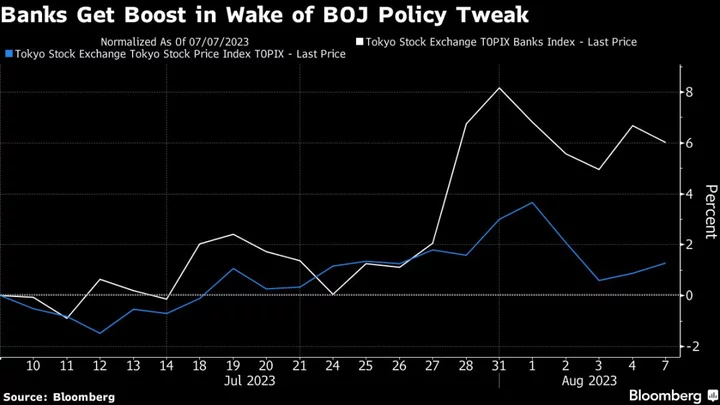

Japanese lenders still have room to rise after the Bank of Japan’s surprise policy tweak last month put them among the nation’s best-performing stocks, according to Lazard Asset Management.

The sector has yet to fully price in the BOJ’s decision on July 28 to raise its ceiling on 10-year government bond yields, said June-Yon Kim, who helps run Lazard Japanese Strategic Equity, which had assets under management totaling $2.3 billion as of March. Lenders have risen 4.2% since the adjustment, the third-biggest gain among the Topix’s 33 sub-indexes.

Higher yields have provided light at the end of the tunnel for banks that have seen interest income crushed by years of rock-bottom rates as the BOJ sought to spark inflation. A policy board member saw the achievement of sustainable 2% inflation clearly in sight, a summary of views at the July meeting showed.

“If you see this move from deflation to inflation, which would mean that you actually see monetary policy normalization, the outlook is also positive for Japanese financials,” Lazard’s Kim said.

Mitsubishi UFJ Financial Group Inc., Mizuho Financial Group Inc. and Sumitomo Mitsui Financial Group Inc. are some of the highest allocations for the Japanese Strategic Equity Fund incorporated in Luxembourg, making up about 14% of its portfolio as of June. It’s up more than 30% so far this year, surpassing the Topix’s 11% gain in dollar terms and beating all peers.

To be sure, the equity market remains split on whether the BOJ is finished with adjusting policy or is preparing to enter a new phase, according to SMBC Nikko Securities analyst Masahiko Sato. While the end of the central bank’s yield-curve-control policy looks unlikely, it would be risky to reduce weightings in bank stocks, the analyst wrote in an Aug. 3 research note.

Lazard is also bullish on Japan’s technology stocks on the view that electric vehicles and automation will boost the industry. Information technology makes up about a 10th of the fund’s portfolio, which is also overweight the materials sector. Semiconductor firms linked to artificial intelligence are among the top performers on the Nikkei 225 Stock Average this year.

“You’re seeing an interesting situation where near-term demand is actually quite bad, and fundamentals remain very spotty but longer-term outlook is improving,” Kim said, referring to the tech sector.

(Uses AUM of Lazard Japanese Strategic Equity in second paragraph. Updates market changes.)