The Korean regulator in charge of a federation of credit unions that’s grappled with delinquencies and withdrawals said there’s been stabilization, after the woes spooked broader markets earlier this month.

Deposit flows at MG Community Credit Cooperatives have definitely stabilized, a spokesperson for the Ministry of Interior & Safety, which oversees the federation, said when asked about the situation this week.

A branch of MGCCC in the city of Namyangju east of Seoul was closed in July, after customers pulled deposits following reports that soured debts linked to project financing had worsened.

Korea has been on alert for risks posed by financial engineering linked to real estate finance, after a default last year by the developer of the Legoland Korea theme park triggered a crisis in the local credit market.

The Bank of Korea said Thursday it was strengthening its liquidity backstop for financial institutions to prevent bank runs, and that it would rescue non-bank institutions if needed. Earlier this month, the Financial Services Commission said the government would take all necessary measures to protect assets of community credit cooperative customers.

“This issue wouldn’t escalate further to shake the financial system, but this will surely continue to dampen construction and facility investment in near term.” said Min Joo Kang, senior economist at ING Groep N.V. in Seoul.

There has been a string of moves by officials to try to contain the broader persistent risks related to real estate finance. In May, regulators encouraged brokerages to swap short-term risky property debt for longer term borrowings.

The recent problems at MGCCC have been a particular concern because credit cooperatives are meant to be anchors of stability for local communities.

The cooperatives originated in the 1960s in rural areas, and were associated with a political initiative that emerged the following decade to modernize the economy in such regions. There are now some 1,295 branches with 260 trillion won ($203 billion) of assets and more than 21 million customers, according to the cooperatives website. Branches take deposits, provide loans and offer insurance services.

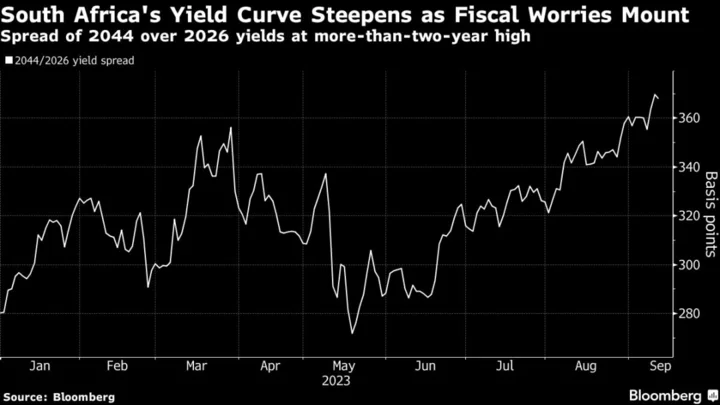

Credit markets reflected mounting risks earlier this month.

Yields on 3-year won-denominated corporate bonds hit their highest since January on July 10, the day Reuters reported authorities had asked banks to earmark financial support for MGCCC.

Korea’s economy contracted in the last three months of 2022, when the credit market rout took place. Although it grew faster than forecast in the second quarter, concerns about the strength of momentum remain.

Authorities earlier this month also urged securities firms to prepare for a prolonged real estate market slump. They cited an increase in defaults on project financing loans and mounting concerns about losses on overseas properties.