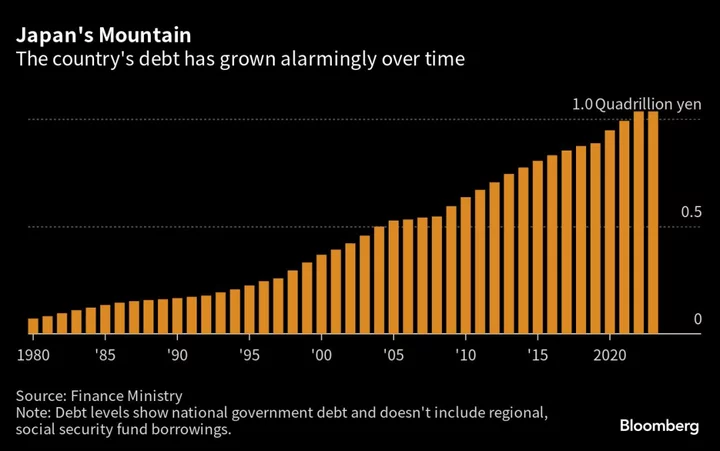

Japan’s Prime Minister Fumio Kishida is facing pressure to increase spending, even as bond yields at a nine-year high and earlier political promises test his ability to secure further funding for the world’s most indebted developed economy.

Kishida pivoted away from his previous stance Tuesday by scrapping September-end plans to stop subsidies that cap gasoline prices. He also pledged to consider fresh economic measures to help households and businesses deal with inflation next month.

His low approval ratings and Japan’s tendency to put together an extra budget at the end of every year are likely at least partly behind the move. But Kishida’s latest bid to spend more also comes just as economists upgrade their views for annual growth this year, calling into question the necessity of additional stimulus.

Kishida’s announcement came hours after Japan’s 10-year bond yields hit the highest level since 2014, putting more pressure on the country’s already significant debt payment burden. The finance ministry plans to seek to raise the assumed interest rate for debt-servicing costs to the highest level in years for next year’s budget, according to people familiar with the matter.

It also comes amid prolonged talks over how to fund Kishida’s signature initiatives to ramp up national defense and childcare support. Still, it may be hard for the prime minister to resist the temptation to bolster spending, with analysts saying he may still call a national election by year-end.

As Kishida navigates multiple pressures, some economists say that the premier’s renewed intention to fight energy costs may put the Bank of Japan in an awkward position. The weak yen — partly spurred by the central bank’s continued lax monetary policy stance — is a key reason behind higher import costs, including energy.

With the yen weakened to levels that prompted the government to intervene in markets last year, Kishida met with Bank of Japan Governor Kazuo Ueda Tuesday. Ueda said they didn’t discuss foreign exchange rates, but many market participants speculate it was one of the topics covered in the meeting.

Kishida also called for a discussion on a broader stimulus package next month. The government is reportedly planning to assist growth industries such as semiconductors and encourage companies to raise wages, according to the Yomiuri newspaper. The report said the government is also considering continuing subsidies to cut electricity and city gas bills beyond October.

The government has persistently maintained that Japan is still looking to balance its budget outside debt servicing costs in the fiscal year starting in April 2025, playing down concerns over ballooning spending.

While credit rating agencies have said that they are closely looking at the BOJ in deciding the nation’s ratings, there is little indication of an imminent change in their assessments so far.

Kim Eng Tan, primary Japan credit analyst at S&P Global Ratings, said Tuesday that as long as the BOJ’s process of normalization doesn’t create major troubles for financial markets and the economy, there won’t be any material impact on the rating.

“In the near one to two years we don’t see the rating changing,” Tan said.

Some analysts note that Kishida’s preference for higher spending could begin to have visible impacts on yields, as it has in other developed nations.

Close attention is warranted on the size of the extra budget later this year, after it reached 29 trillion yen ($199 billion) last year, according to Chotaro Morita, senior fellow at SMBC Nikko Securities.

“There is a possibility that, even in Japan, excessive fiscal spending will finally have direct impact on long-term yields,” Morita said in a note Wednesday.