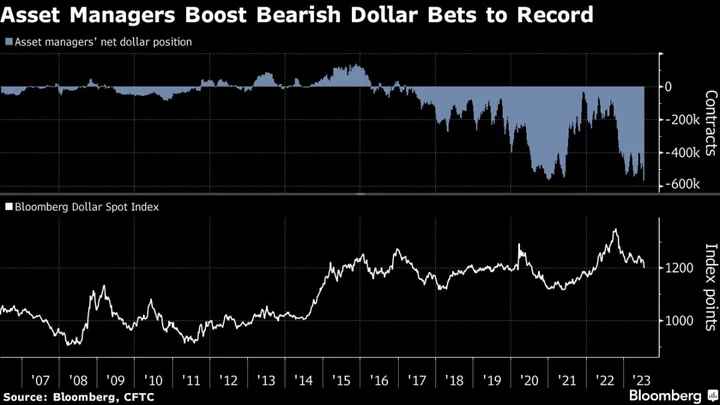

Japanese investors bought the most US sovereign bonds in six months in September, underscoring fund flows into higher-yielding debt that are weighing on the yen.

Funds based in Japan purchased a net ¥3.31 trillion ($22 billion) of Treasuries in September while they sold debt in most other sovereign markets tracked by the Ministry of Finance, according to data released Thursday.

Yields on US 10-year Treasuries climbed 46 basis points during the month to finish at 4.57%, compared with an increase of 12.5 basis points to 0.765% for the Japanese equivalent. US yields have fallen sharply in recent sessions to leave them lower than end-September while Japanese rates have risen, but there’s still a gap of more than 3.5 percentage points.

“The US yield rose significantly during the month to a level attractive for Japanese investors and accelerated their purchases,” said Tsuyoshi Ueno, senior economist at NLI Research Institute in Tokyo. “It was a month of funds shifting to the US as speculation grew that the US will keep borrowing costs higher for longer. There’s the risk that the yen may appreciate, but the US yield offers quite a lot of buffer against it.”

Global investors are closely watching whether Japanese funds will bring back their cash to the home market, unloading securities from Treasuries to European and Australian debt in the process, as speculation grows that the central bank is poised to end its super-easy monetary policy soon.

The latest data indicate though that the wide yield gap with the US is still luring Japanese investors into American debt: they’ve been net buyers of sovereign bonds from the world’s biggest economy every month in 2023 except April and July.

The yield differential has put pressure on the yen to weaken despite government officials in Japan warning that they may take action against excessive exchange rate moves. The Japanese currency fell to a one-year low of 151.72 per dollar on Oct. 31, and traded near that level at 150.89 as of 11:34 a.m. on Thursday.