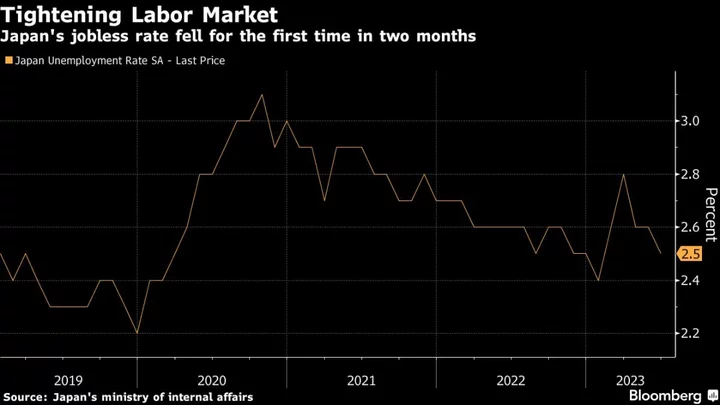

Japan’s unemployment rate fell in June, feeding into optimism that upward pressure on wages may persist and help Bank of Japan Governor Kazuo Ueda achieve his goal of sustainable inflation.

The jobless rate fell to 2.5%, the ministry of internal affairs said Tuesday, the lowest since January. Economists had forecast the reading would hold at 2.6%. The number of workers rose by 190,000 from the previous month, while those without jobs fell by 40,000.

Separate data also suggest that labor demand remains more or less steady, with the jobs-to-applicants ratio nudging one tick lower to 1.30. Economists had forecast a rise to 1.32.

The gauge is a leading indicator for employment trends and shows there were 130 jobs offered in June for every 100 applicants, compared with 131 a month earlier. Job offers rose for lodging, restaurant and education services workers, while those for manufacturing roles fell at a double-digit clip.

“Compared with pre-covid times, the additional labor supply of older workers is declining, as is the additional female work labor force,” said Uichiro Nozaki, an economist at Nomura Securities Co. “Tighter labor markets will likely continue to lead to higher wages.”

Tuesday’s data implies that Japan’s labor market is steadily tightening on the back of a recovery from the pandemic. Consumer confidence is edging higher, and the number of arrivals from overseas recovered last month to more than 2 million, or more than 70% of pre-pandemic levels, according to the Japan National Tourism Organization. That’s spurred demand for workers in the services sector, as reflected in recent surveys including the Bank of Japan’s Tankan and the Cabinet Office’s Eco Watchers.

What Bloomberg Economics Says...

“The return of overseas tourists continues to spur demand for workers in the labor-intensive service sector. Meanwhile, carmakers and other manufacturers are hiring more as production recovers from semiconductor shortages. Looking ahead, the labor market will tighten gradually as reopening from Covid keeps service-sector demand strong.”

— Taro Kimura, economist

For the full report, click here

The result may presage further upward pressure on wages. Workers at some Japanese companies recently achieved historic pay gains due in part to a push by the government. Authorities at the BOJ are watching closely to see if workers will be able secure similar wage gains beyond this year.

The BOJ highlighted its concerns about wage growth and its impact on prices in its Outlook report published last Friday: “If the behavior and mindset based on the assumption that prices and wages will not increase easily remain deeply entrenched, there is a risk that moves to increase wages will not strengthen as much as expected from next year and prices will deviate downward from the baseline scenario.”

Tuesday’s figures may be welcome news for Prime Minister Fumio Kishida, who has identified a labor market shakeup as one of his top priorities. The premier has proposed a series of measures aimed at reforming the country’s labor market in hopes of boosting wages, including supporting workers who seek new skills and relaxing the unemployment benefit system for those who leave their jobs for personal reasons.

Still, progress on that front has been slow due to entrenched employment practices. “It will take time before Kishida’s labor market reforms are reflected in the outcome,” Nomura’s Nozaki said.

The employment statistics offer some implications for future economic conditions in the world’s third largest economy. Japan’s economy is in a modest recovery as business investment remains resilient despite fears of a global slowdown. The gross domestic product figure for the April-June period will be released in mid-August.

(Adds economist’s comments, context for BOJ.)