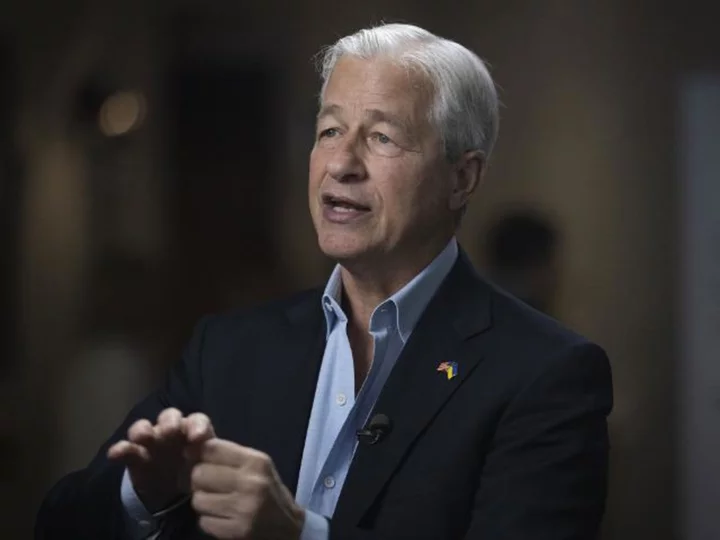

Economists are concerned about the $20 trillion commercial real estate (CRE) industry and so is JPMorgan Chase CEO Jamie Dimon.

The regional banking crisis is having a knock-on effect on commercial real estate lending, Dimon warned at his company's shareholder meeting on Monday.

What's happening: "There's always an off-sides," Dimon said, using Wall Street jargon for an indirect consequence. "The off-sides in this case will probably be real estate. It'll be certain locations, certain office properties, certain construction loans. It could be very isolated; it won't be every bank."

Office and retail property valuations have been falling since the pandemic brought about lower occupancy rates and changes in where people work and how they shop. The Fed's efforts to fight inflation by raising interest rates have also hurt the credit-dependent industry.

Recent banking stress has significantly added to those woes. Lending to commercial real estate developers and managers largely comes from small and mid-sized banks, where the pressure on liquidity has been most severe. About 80% of all bank loans for commercial properties come from regional banks, according to Goldman Sachs economists.

"You're already seeing credit tighten up because the easiest way for a bank to retain capital is not to make the next loan," said Dimon.

Regulatory changes made in response to the collapse of Silicon Valley Bank and Signature Bank will also likely lead small banks to tighten access to their credit, he said.

As capital tightens up, added Dimon, interest rates could go even higher. "I think everyone should be prepared for rates going higher from here," he said.

Nearly 85% of investors are pricing in a pause in interest rate hikes at the next Federal Reserve meeting, according to the CME FedWatch Tool.

What else: A US debt limit crisis is looming, regional banks are still contending with their own turmoil and recession predictions abound. But Dimon, arguably the most powerful executive in the United States, seemed fairly relaxed about it all on Monday.

Dimon, who heads the largest bank in the country, appeared upbeat in an open-collar shirt as he answered questions from investors. He walked on stage to the theme from Rocky.

Dimon, 67, also spoke candidly about his succession plans. While there are plenty of qualified and competent internal candidates for his spot, he said, he doesn't plan to step down anytime soon.

"I still love what I do," he told investors Monday. "I can't do this forever, I know that. My intensity is the same. I think when I don't have that intensity, I should leave."

Corporate bankruptcies are on the rise

It's been a big year for high-profile corporate bankruptcies.

From Bed Bath & Beyond and Vice Media to David's Bridal and Party City, companies have been going belly-up at an alarming rate. And it's not getting any better. Last week, corporate America had its worst 48-hour stretch of bankruptcies since at least 2008, reports my colleague Samantha Delouya.

The tally of companies that went bankrupt between January and April was higher than the first four months of any year since 2010, according to data from S&P Global Intelligence.

So what's going on?

James Gellert, CEO of Rapid Ratings International, a company that evaluates the financial health of public and private companies, said many of these troubled businesses have similar traits.

"The big themes are that they have degraded in operational quality and have debt that has been unsustainable," he said. "That is the formula for bankruptcy in this market."

The Federal Reserve may have also played a role in the collapses.

Elevated interest rates have led to a credit crunch, making it difficult for companies in need to borrow funds from banks. That effect will likely continue even after the Fed has finished its current round of rate hikes, said Gellert.

"If you look back to the financial crisis, the market bottomed in March 2009, and you were still seeing bankruptcies throughout that year, even as the market was doing better," he said. "There's still going to be trouble going forward," he said.

Biden and McCarthy emerge from debt ceiling talks with no deal

US President Joe Biden and Republican House Speaker Kevin McCarthy met at the White House again on Monday evening to try and hammer out a deal to avoid a catastrophic government default on debt.

But after hours of negotiating the pair emerged without one.

Still, McCarthy said talks would continue every day until a deal was made, striking a more optimistic tone than he had after previous meetings.

"We literally talked about where we are having disagreements and ideas," McCarthy told the press. "So to me that's productive. Not progress, but productive."

"We're optimistic we may be able to make some progress," Biden added.

US Treasury Secretary Janet Yellen reaffirmed on Sunday that June 1 is the "hard deadline" for the United States to raise the debt ceiling or risk defaulting on its obligations.

Still, Wall Street appears to be shaking off the approaching X-date, now just nine days away.