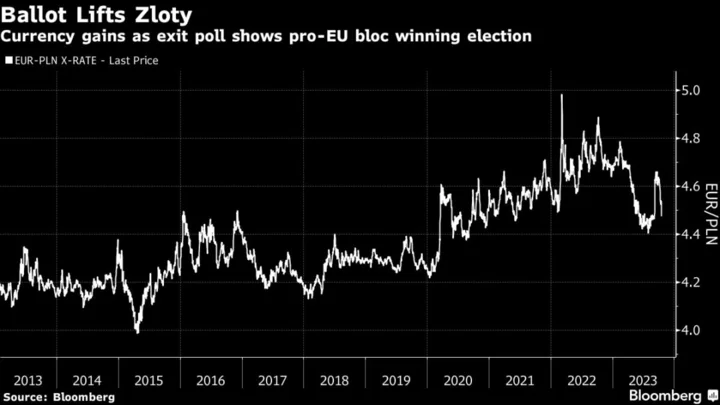

Investors piled cash into Poland as a bloc of pro-European opposition parties are on track to unseat the nationalist government following Sunday’s election.

The benchmark WIG20 Index rose 3.5% on Monday, the most since June, as it built on the biggest weekly gain since April driven by expectations for the opposition’s win. The zloty traded 1.1% higher, its eighth increase in the past nine days. The nation’s local-currency bond due 2033 jumped, shaving the yield by 23 basis points.

Read more: Poland’s Pro-EU Opposition to End Eight Years of Populist Rule

An exit poll and partial official results showed the three-party opposition alliance winning 248 seats in the 460-member lower house of parliament. The outcome, if confirmed by final results due by Tuesday, is seen as beneficial for Poland’s economy and finances as a new administration may move to quickly unfreeze access to tens of billions of euros in European Union funds held up over the current government’s rule-of-law infringements.

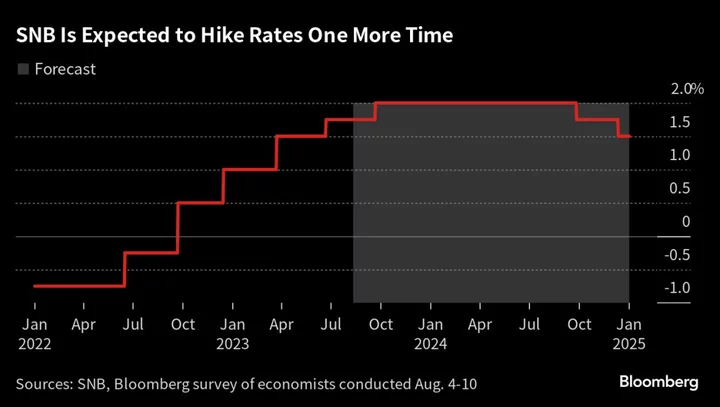

Some analysts, including at Goldman Sachs Group Inc. and Morgan Stanley, expect the central bank to turn more hawkish.

“Near-term, this is very positive and opens the door for a normalization” of EU relations and makes the release of funds “likely,” said Henrik Gullberg, a macro strategist at Coex Partners Ltd. “Further good news for the zloty would be if the central bank became more orthodox.”

Goldman economist Kevin Daly said he expected that to happen.

“We expect the central bank reaction function to now turn more hawkish as Governor Adam Glapinski’s voting record has previously been more hawkish under a Civic Platform-led government,” Daly wrote in a note.

Meanwhile, analysts from Erste Group Bank AG saw the strengthening of the zloty and chances of a more favorable policy toward the banking sector as opportunities, especially for state-controlled lenders. That drove stocks higher as it boosted optimism for lower inflation and a possible rejig of policymakers.

Long Path

Still, the handover of power is likely to take time. Prime Minister Mateusz Morawiecki said on Sunday night that the Law & Justice party — which is still the biggest party in parliament — is ready to discuss coalition talks with “everyone.”

Aides for President Andrzej Duda said that Polish political custom is for the head of state to nominate someone from the largest party in parliament as prime minister. The opposition said this would waste time by stalling the creation of a majority cabinet by the current opposition bloc, and may create a power vacuum at a dangerous moment with a war raging in neighboring Ukraine. Law & Justice has no path toward a majority if the exit poll is confirmed, according to the opposition.

“Investors see that the status quo in Poland has changed, which should bode well for the zloty and stocks,” said Radoslaw Cholewinski, a board member at mutual fund Skarbiec TFI in Warsaw. “This picture could change, however, if Law & Justice doesn’t concede.”

The zloty has been Europe’s best performing emerging-market currency against the euro over the past month, while Warsaw listed stocks also outperformed peers. The turnaround was partly fueled by bets that the pro-EU opposition — which combines center-right, centrist and leftist parties — could jointly win a majority.

“The situation is going to be volatile,” said Viktor Szabo, an investment director at Abrdn in London. “It looks like the opposition has sufficient support to form a coalition, which should be positive over the medium term. However, it won’t be an easy coalition.”

--With assistance from Agnieszka Barteczko and Barbara Sladkowska.

(Recasts throughout with latest on results, market moves)