By Lewis Krauskopf and Naomi Rovnick

(Reuters) -Fears of a widening conflict in the Middle East are threatening more volatility for investors after a painful stretch in U.S. markets.

Israel's troops were battling on Monday to clear out Hamas gunmen more than two days after they burst across the fence from Gaza on a deadly rampage, and the army said it would soon go on the offensive after the biggest mobilization in Israeli history.

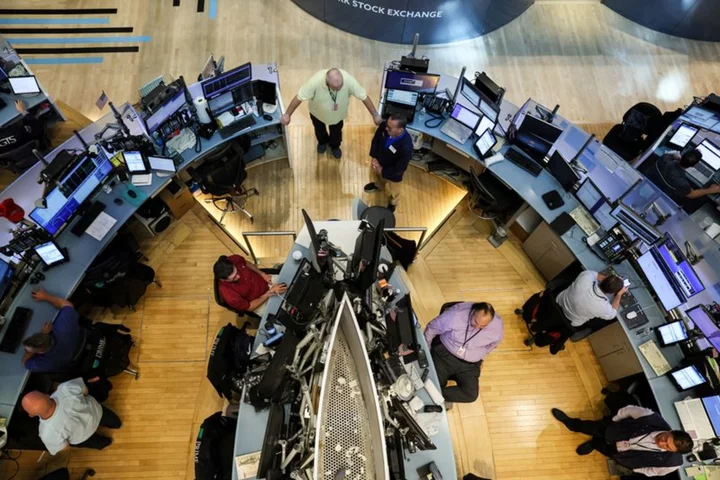

Investors were on guard for the potential of the conflict spreading to embroil other countries, including Iran, and a continued spike in oil prices. The S&P 500 was down 0.3% on Monday morning, while Brent crude was up around 4% to $88.10 per barrel. Prices for gold, a popular destination for investors during uncertain times, were up 0.9% at $1,849.40 per ounce.

"The coming days are likely to be driven by geopolitical risks, rather than fundamentals,” said Mohit Kumar, chief Europe economist at Jefferies in London. "For markets, the geopolitical risks add another uncertainty for investors when convictions are already low."

Geopolitical events have, in many cases, had only fleeting effects on markets. Nevertheless, the escalating conflict comes at a time of heightened uncertainty for investors, as they grapple with a historic sell-off in U.S. Treasuries and volatility in stocks.

Market participants said repercussions from the conflict risked exacerbating several trends that have weighed on risk assets in recent months. Among those is a potential rebound in oil prices that could weigh on U.S. economic growth and endanger the so-called soft landing narrative that has helped boost stocks this year.

“The worst-case scenario from a geopolitical risk perspective would be a full-scale confrontation between Israel and Iran,” said Tina Fordham, geopolitical strategist and founder of Fordham Global Foresight. "A return to the risk of direct military tensions - especially the risk of Israeli attacks on Iran's nuclear facilities - would likely have systemic impact.”

A widening conflict could keep oil prices elevated and potentially act bolster inflation, she said. That could complicate the picture for the Federal Reserve and other global policymakers, who have been seeking to tamp down consumer prices after last year's surge.

"All of this is going to circle around oil,” said Paul Nolte, Senior Wealth Advisor and Market Strategist, Murphy & Sylvest Wealth Management. "Energy is going to be the key here as to whether (the impact on the economy) is going to be temporary or longer lasting."

Soaring Treasury yields have pressured equities, with the S&P 500 off roughly 6% from its late July highs, though the index is up 12% for the year. Yields on the benchmark 10-year US Treasury - which move inversely to bond prices - stand at their highest levels in more than a decade and a half.

U.S. earnings season, which kicks off on Friday, is expected to add another measure of uncertain. Meanwhile, investors are also bracing for inflation data slated for Thursday.

"I think this is just an extra source of concerns and the timing is not ideal, because the commodity market is already quite stretched, the bond market is quite stretched,” said Emmanuel Cau, Barclays head of European equity strategy.

Shares of Israeli companies slumped on Wall Street, with Mobileye Global, the driverless car software company controlled by Intel, and software maker Monday.com both dropping almost 6%. Solar power technology company Solaredge Technologies fell 5.4%.

For safe-haven government bond markets, worries about renewed tensions in the Middle East took the sting out of a brutal selloff that has seen 10-year borrowing costs from the United States to Germany to multi-year highs. The U.S. bond market was closed on Monday but U.S. Treasury futures - contracts for the purchase and sale of bonds for future delivery - were rising amid a flight to quality.

Prices of 10-year Treasury futures rose to 107-20/32 on Monday, their highest in a week. Two-year, five-year and 30-year futures were also higher.

Althea Spinozzi, senior fixed income strategist at Saxo Bank, said that while an escalation in tensions in Israel might boost the allure of U.S. Treasuries for haven-seeking investors, the risk of a rising commodity prices and looming Treasury auctions might limit any fall in yields.

"Within this environment, we remain defensive and wary of duration," she said.

(Reporting by Naomi Rovnick, Lewis Krauskopf, Dhara Ranasinghe, Davide Barbuscia and Marc Jones; Writing by Ira IosebashviliEditing by Nick Zieminski)