Emerging-market investors are looking at a devaluation of Nigeria’s naira after the suspension of the country’s central bank governor Godwin Emefiele.

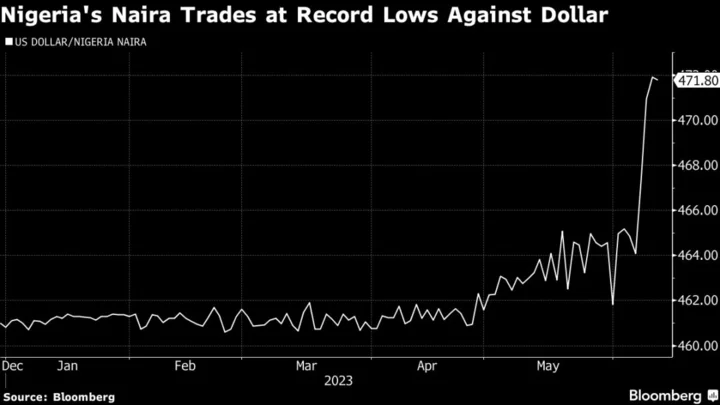

Analysts are considering how soon a devaluation may happen and how deep it will be, following the removal late Friday of a policy chief whose unorthodox policies included propping up the naira and banning access to foreign exchange for imports. The currency steadied Monday at 471.80 per dollar, having fallen for three weeks to hit a record low.

Speculation over a potential devaluation has been rising since the election in February of Bola Tinubu as president, who dismissed Emefiele after having pledged to “carefully review and better optimize” the naira system. Africa’s largest economy operates a multiple exchange regime dominated by a tightly controlled official rate, which drives demand to the unauthorized black market.

Nigeria’s Suspended Central Bank Governor Taken Into Custody

Here’s what some money managers and analysts are saying about Emefiele’s removal and what it may mean for the naira from here:

Patrick Curran, senior economist at Tellimer in London:

- “Emefiele’s removal is a necessary precondition to shift to a functioning monetary policy and exchange rate regime and will be welcomed by markets”

- “However, it remains to be seen what form the exchange rate adjustment will take — namely, will it be large enough to clear the market and will it be allowed to float thereafter or will it simply be a one-off devaluation to a new managed or pegged exchange rate, allowing imbalances to build back up”

- “In the near-term, the official exchange rate likely needs to converge with the parallel rate of around 765/SUD to begin to clear pent-up imbalances, but it is not yet clear if the new administration will be able to stomach such a large up-front adjustment”

Mark Bohlund, senior credit research analyst at REDD Intelligence:

- “CBN policymaking under Emefiele has been underwhelming”

- “I continue to expect a devaluation to come in the next six months (2H23) as the inflationary impact of the phasing out of fuel subsidies has subsided. I expect a devaluation to NGN 650-700/USD”

Bojosi Morule, economist at Goldman Sachs International in London:

- “Along with the rapid removal of fuel subsidies, we interpret Emefiele’s suspension as likely to be an indicator of another important and decisive policy shift, following the transition from the Buhari administration”

- “FX policy — specifically the overvalued Naira and multiple exchange rate regime — has been a key negative for the macroeconomic environment and impediment to investment in recent years, we interpret the leadership change at the CBN, likely to be accompanied by a policy shift, as credit-positive”

- “Tinubu has expressed a preference for a “unified exchange rate”, we think that the leadership change likely increases the probability of a near-term devaluation of the Naira”

- On our estimates, an adjustment of the Naira to around NGN 700-750

Thys Louw, portfolio manager at asset manager Ninety One in London:

- “Overall, President Tinubu has shown that he’s willing to take on two of the most important factors investors are focusing on, which is fuel subsidies and FX reform in a very short space of time

- In as much as Emefiele was seen as a impediment to implementing the changes on the FX side, his suspension can be seen as a positive step with regards to reform implementation

- He is unlikely to change his Nigeria credit position meaningfully on the back of this as bonds already reflect some of the reform momentum, but it does suggest outperformance can continue

--With assistance from Sujata Rao.