The UK economy will grow faster than Germany this year and avoid a recession, the International Monetary Fund said, after sharply upgrading its forecast on the back of strong household spending and better relations with the European Union.

Falling energy prices will also help Britain expand 0.4% this year, the IMF said on Tuesday in its regular health check on the UK economy. That’s up from the 0.3% contraction the fund projected just last month, and which will lift the UK off the bottom of the G-7 league table.

However, the global economic watchdog warned households that interest rates may need to rise further and stay high to ensure inflation is dealt with properly.

The prospect of faster growth will raise hopes in Prime Minister Rishi Sunak’s government that it can head into an expected general election next year offering tax cuts. The ruling Conservatives trail Labour by a double-digit margin in the polls as the country grapples with soaring inflation, weak growth, public sector strikes and rising taxes.

Sunak is trying to restore the government’s reputation for economic competence after the disaster of former premier Liz Truss’s economic plans last year, which sank the pound and roiled the bond markets.

In its regular Article IV report on the British economy, the IMF said its upgrade reflected better wage growth and “improved confidence amid somewhat reduced post-Brexit uncertainty.” But it also said households should brace for a tough second half of the year when the “peak impact” of higher borrowing costs will be felt.

Interest Rates

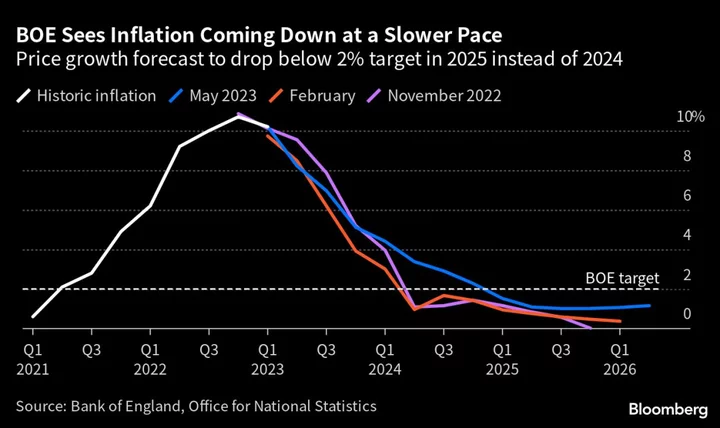

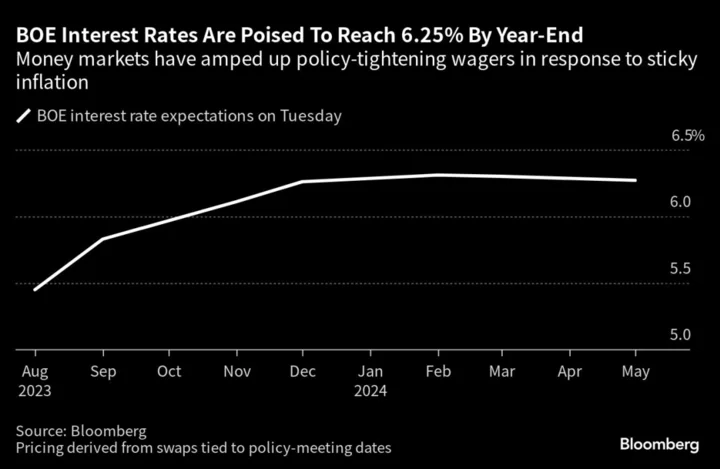

The BOE has raised rates to 4.5% from 0.1% since December 2021, the most aggressive cycle since the 1980s, but “some further monetary tightening will likely be needed, and rates may have to remain high for longer to bring down inflation more assuredly,” the IMF said.

Official UK data on Wednesday is expected to show inflation dropping to about 8.4% from 10.1% as a result of falling energy prices. The IMF expects inflation to fall to 5% by the end of the year, meeting Sunak’s pledge to halve the headline rate, but cautioned that it may “plateau at an elevated rate.”

The BOE’s remit is to bring inflation down to 2%, and the fund cautioned against “premature celebrations” by easing up as inflation automatically drops.

It also urged the government to beef up investment and spend more on Britain’s ailing public services to boost growth. Full-expensing, the government’s generous three-year 100% tax relief on capital investment, should be made permanent, planning should be reformed and the immigration regime needs “fine-tuning to alleviate sectoral and skilled labor shortages.”

With little headroom for extra spending, the IMF urged the government to raise funds by scrapping the triple lock on pensions — which ensures they rise by the highest of wages, inflation or 2.5% - and move to the simpler and less expensive “best practice of inflation-indexation.”

On the banks, the IMF said the UK should build a pre-funded deposit insurance regime like in the US to make it easier to handle any future bank collapses like Silicon Valley Bank UK earlier this year.

(Adds interest rates, further details from IMF report starting in seventh paragraph.)