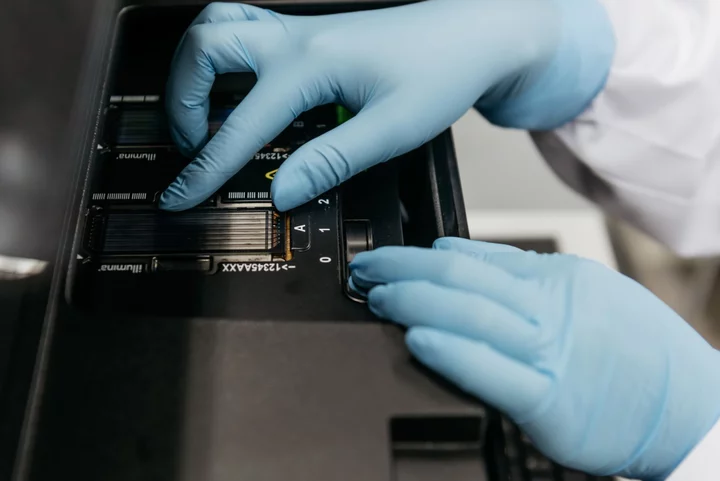

Illumina Inc. was hit with a €432 million ($476 million) fine for acquiring cancer-test provider Grail Inc. before securing regulatory approval from the European Union.

The fine is the highest the European Commission could impose. DNA-sequencing giant Illumina vowed to challenge the decision, calling it “unlawful, inappropriate and disproportionate.”

To probe Illumina’s $7 billion acquisition of Grail, the commission used new powers to regulate takeovers of startups with little or no revenue that previously slipped under the antitrust radar.

“If companies merge before our clearance, they breach our rules,” EU competition commissioner Margrethe Vestager said Wednesday. “Illumina and Grail knowingly and deliberately did so by implementing their tie-up as we were still investigating.”

New antitrust powers were adopted in 2021. The fine represents just under 10% of Illumina’s revenue last year and dwarfs the previous EU penalty for jumping the gun on a deal.

Grail was fined €1,000. The company was spun off from Illumina in 2016 to develop a blood test to detect 50 types of cancer in early stages. Illumina then sought to buy back the startup, closing the deal in August 2021 without awaiting regulatory approval.

The combination risks “stifling innovation and reducing choice” for early cancer detection tests, according to the commission. The maximum fine is intended as a deterrent, it said.

An EU order for Illumina to actually divest Grail is expected to come later in the year, according to people familiar with the matter. The commission has laid out a roadmap for the firms to “swiftly” unwind the takeover, warning that Illumina’s moving ahead with the deal was “a very serious infringement.”

Two US Companies

Illumina is challenging the EU merger veto in the bloc’s courts. The company has said the commission had no jurisdiction over the transaction, which is between two American companies with no foreseeable impact on competition in Europe.

In a statement, Illumina also argued that the deal’s time frame relied on statements by the commission that it wouldn’t assert jurisdiction over mergers of this type before issuing new guidelines, which it then did, and that the companies were kept separate when the deal closed.

US antitrust authorities also told the companies to divest Grail, a decision Illumina is appealing as well.