Iceland’s central bank unexpectedly kept western Europe’s highest borrowing costs on hold as two and a half years of tightening begins to bite, cooling the island’s economy.

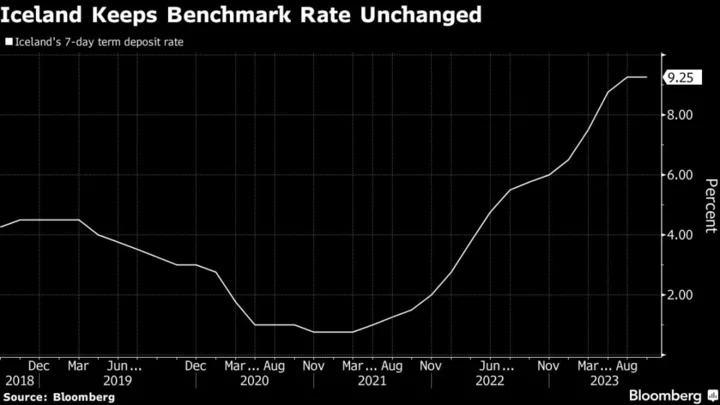

The Monetary Policy Committee in Reykjavik left the 7-day term deposit rate at 9.25% on Wednesday after 14 consecutive rate increases. The island’s two largest lenders both expected hikes.

Rate increases totaling 850 basis points since May 2021 have finally started to show an impact, with private consumption easing in past months even as robust tourism and export revenues still keep spurring the north Atlantic economy. Governor Asgeir Jonsson has kept the door open to double-digit borrowing costs.

Officials stressed the importance of economic data and new forecasts due at their next meeting, for the decision to stay on hold, but indicated considerations for further tightening.

“At this point in time, there is some uncertainty about economic developments and about whether the current monetary stance is sufficient,” they said.

The pause comes as other regional peers are also close to ending monetary tightening, with Norway’s central bank signaling one more quarter-point move later this year and Sweden’s Riksbank also keeping the door open to another hike.

An increase in real rates “actually seems to weigh more heavily in the central bank’s decision than I expected it to do,” Jon Bjarki Bentsson, chief economist at Islandsbanki, said by phone.

“We expect that the growth in demand is slowing and that inflation will subdue considerably next year,” he said. “As it looks today, there’s a good chance that the rate hiking process is over.”

The inflation rate — now at 8% — has grown for two months in a row after falling from the February peak of 10.2%. Higher prices of services drove the recent increase, with housing prices also gaining slightly after having eased in two previous months.

Read More: Iceland Inflation Quickens, Adding Pressure for Further Hike

The committee said underlying price growth “has tapered off slightly.” It added there are “signs that price increases are somewhat less frequent than before, and less widespread,” while inflation expectations are “still too high.”

While the governor earlier this year cited lack of fiscal policy support among factors working against his aims, the government pledged in August to balance its budget two years ahead of earlier plan, by 2025. That’s in line with advice by organizations including the International Monetary Fund and the OECD.

Read More: Iceland Aims for Balanced Budget Two Years Ahead of Plan

The krona has gained about 4% versus the euro this year — helping the central bank’s job in reducing imported price growth — even after erasing some of its earlier gains since September. The currency was little changed at 145.91 against the euro at 8:41 a.m. in Reykjavik.

The central bank faces additional pressure to quell inflation as another round of wage talks is imminent for the bulk of private sector workers whose one-year contracts run out next January. Previous pay deals yielded higher wages than the policymakers expected, fanning fears of a wage-price spiral similar to ones that have stunted Iceland’s economy in the past.

Islandsbanki hf, one of the country’s biggest lenders, expected a quarter-point increase, while its peer Landsbankinn hf projected a half-point raise.

--With assistance from Joel Rinneby.

(Updates with details, background from fifth paragraph, economist quote from seventh)