Wall Street’s elite gathered for a second day in Hong Kong for the city’s annual financial summit to discuss topics ranging from risks to China and investing.

Wednesday’s speakers include the heads of Capital Group, Fidelity International and Hillhouse. The conference was conceived last year to restore confidence in Hong Kong after years of Covid restrictions and a tightening political climate raised questions about the city’s viability as the region’s premier financial hub.

(All times are HK time)

China Is a Big Opportunity for BlackRock (9:32 a.m.)

China is experiencing a massive drive to diversify retirement savings away from real estate and deposits to other investments that are more capital-markets driven, so this is a big opportunity for BlackRock, said Senior Managing Director Mark Wiedman, the firm’s head of global client business.

“Cyclically, this is a difficult time in China,” Wiedman said on a panel about the macro landscape. “People talk about China like US-China tensions are the driver. It’s actually domestic policies, domestic investments that are the long-term opportunities in China.”

Capital Group’s new president and CEO Mike Gitlin said China is undergoing an economic transition that will take decades and investors should “lean into” areas which will most benefit from government policies.

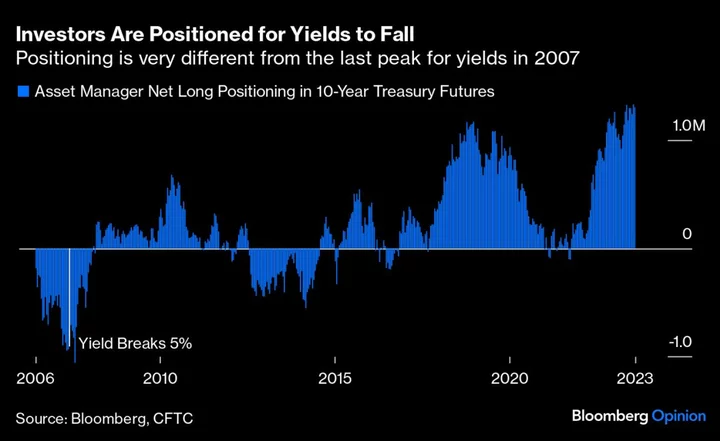

Bonds Offer Window of Opportunity (9:12 a.m.)

There is a window of opportunity for investing in bonds if market assumptions that interest-rate hiking cycles are ending are accurate, said Capital Group’s Gitlin. If bond yields can reach 6% to 7%, that would be similar to most people’s long-term capital market assumptions for equities, he said.

$4 Trillion of Cash Is On The Sidelines (9:08 a.m.)

The huge pile of cash waiting on the sidelines is a major issue facing global investors as they figure out where capital is going, said BlackRock’s Wiedman.

“There’s about $4 trillion of cash that is sloshing around waiting for action,” he said. “We don’t know when that cash will come back in but that’s the first big overhang that clients talk about all the time.”

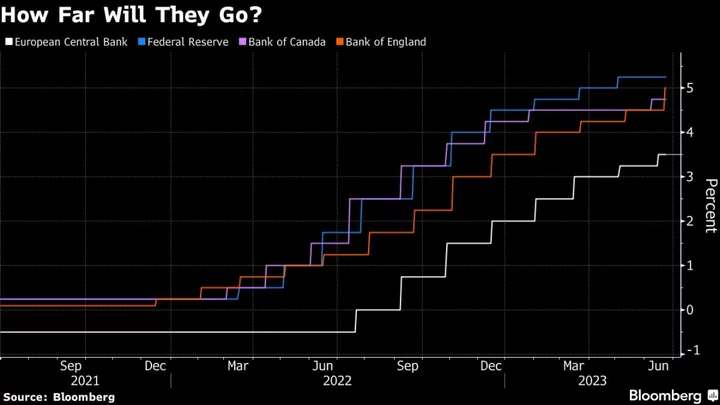

US Elections to Make Central Banks Cautious (9:00 am)

Central banks globally are going to be wary about doing anything drastic in a US election year, said Anne Richards, CEO of Fidelity International. Interest rates will stay higher for longer, but are less likely to “have big jumps in either direction,” she said.

--With assistance from Paul van Deventer, Joanne Wong, Harry Suhartono and Lulu Yilun Chen.

(Corrects spelling of BlackRock in headline)